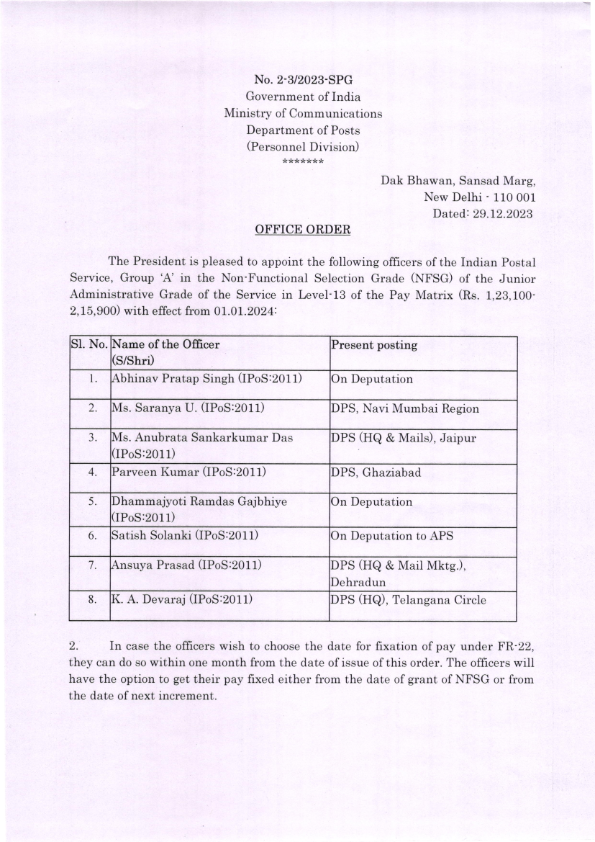

Placement of Junior Administrative Grade (JAG) Officers of Indian Postal Service (IPoS), Group ‘A’ in Non- Functional Selection Grade in Level 13 (Rs. 1,23,100–2,15,900) of the Pay Matrix w.e.f. 1st January, 2024.

Sunday 31 December 2023

Whether restoration of Commuted Pension after 12 years is rejected?

Whether restoration of Commuted Pension after 12 years is rejected?

Click the below link

http://dlvr.it/T0mdDh

Saturday 30 December 2023

Press release dated 29.12.2023 by Labour Bureau:-

Press release dated 29.12.2023 by Labour Bureau:-

AIASC (Gr. B) CHQ writes to the Secretary (Posts), New Delhi regarding grant of HSG-I (NFG) to HSG-I Cadre after 2 years service

AIASC (Gr. B) CHQ writes to the Secretary (Posts), New Delhi regarding grant of HSG-I (NFG) to HSG-I Cadre after 2 years service

Friday 29 December 2023

Thursday 28 December 2023

Reservation in promotion to Persons with Benchmark Disabilities (PwBDs) – Notional Promotion from 30.6.2016: DoP&T OM dated 28.12.2203

Reservation in promotion to Persons with Benchmark Disabilities (PwBDs) – Notional Promotion from 30.6.2016: DoP&T OM dated 28.12.2203

No. 36012/1/2020-Estt (Res-II)

Government of India

Ministry of Personnel, Public Grievances & Pensions

Department of Personnel & Training

North Block, New Delhi,

Dated the 28th December, 2023.

OFFICE MEMORANDUM

Subject: Reservation in promotion to Persons with Benchmark Disabilities (PwBDs) regarding.

The undersigned is directed to say that the Hon’ble Supreme Court, vide its Judgement dated 30.6.2016, in the WP(C) No.521/2008, titled ‘Rajeev Kumar Gupta Vs. U01, had directed the Government to extend three percent reservation to PWD in all identified posts in Group A and Group B, irrespective of the mode of filling up of such posts. However, subsequently the Hon’ble Supreme Court, vide its Order dated 3.2.2017, in the Civil Appeal No. 1567/2017 titled Siddaraju Vs. State of Karnataka & Ors.’ referred to the prohibition made against reservation in promotion as laid down by the majority in Indra Sawhney & Others v. Union of India & Others (1992) and observed and held that its Judgement dated 30.6.2016 in Rajeev Kumar Gupta needed to be considered by a larger Bench. However, the Hon’ble Supreme Court finally disposed of the Siddaraju matter vide its Judgement dated 14.1.2020 and held that its Judgement in Rajeev Kumar Gupta would bind the Union and State Governments and it must be strictly followed.

2. However, the Union of India needed some clarification with regard to the implementation of the Hon’ble Supreme Court Judgement dated 30.6.2016 and 14.1.2020, and, therefore, Application for Clarification was filed by the UOI before the Hon’ble Supreme Court seeking clarification which inter alia included whether the vacancies for promotion for PwDs would be computed only on the basis of the vacancies against the identified posts or against the vacancies in both identified and non-identified posts and whether the judgement dated 14.1.2020 needs to be implemented on the basis of PwD Act, 1995 or RPWD Act, 2016. Hon’ble Supreme Court disposed of this Application for Clarification vide its Order dated 28.9.2021 directing the Government of India to issue instructions regarding reservation in promotion as provided in Section 34 of the RPwD Act, 2016.

3. Proviso to Section 34 of the RPWD Act, 2016 provides that the reservation in promotion shall be in accordance with such instructions as are issued by the appropriate Government from time to time. Accordingly, DoPT vide its OM of even number dated 17.5.2022 issued detailed instructions for extending the benefit of reservation in promotion to PwDs up to the lowest rung of Group A’ in posts and services under the Central Government. This OM is effective with effect from the date of its issue i.e. 17.5.2022.

4. However, in a Contempt Petition (Civil) No.873/2023 filed by Shri S. S. Sundaram against Department of Revenue, the Hon’ble Supreme Court vide its order dated 18.7.2023 has directed “Though it is pointed out that the judgement of this Court of which breach is alleged, has been complied with effect from 1572023, the fact remains that the judgement is of 30.6.2016 directing the respondents to implement the 1995 Act. Therefore, the respondent will have to consider of giving at least notional promotion to those who are eligible from an earlier date’.

5. The aforesaid directions dated 18.7.2023 of the Hon’ble Supreme Court has been considered in consultation with the Department of Legal Affairs and it has been decided to grant notional promotions to the PwD candidates w.e.f. 30.6.2016 as under:

(i) PwD employees in posts and services of the Central Government, will be considered for grant of the benefit of reservation in promotion up to the lowest rung of Group ‘A’ on notional basis w.e.f. 30.6.2016 subject to their fulfilment of the eligibility conditions as laid down in the DoPT OM of even number dated 17.5.2022 regarding reservation in promotion to PwDs. However, the extent of reservation in promotion may be in accordance with the relevant provisions contained in the PwD Act 1995 and RPWD Act 2016. Further, this benefit may be extended after holding Review DPC as per the extant instructions issued by DoPT on the subject. In case the PwD employees are found eligible and suitable for promotion from any date subsequent to 30.6.2016, then the benefit of reservation in promotion may be extended to them from the date they become eligible for promotion. This promotion on notional basis includes promotion on seniority quota as well as Departmental Examination/Departmental Competitive Examination. In case of Departmental Examination/Departmental Competitive Examination, which has already been held during the period from 30.6.2016 to 16.5.2022, the eligibility of the PwD candidates may be assessed on the basis of their performance in the said examination. The concerned Administrative Authorities are given discretion to consider holding of special examination for assessing the suitability or eligibility of PwD employees for such Departmental Competitive Examination.

(ii) Any such promotion during the period from 30.6.2016 till the PwD employee actually assumes the charge of the post will be only on notional basis and the actual financial benefit of promotion will be effective to them with effect from the date they, actually assume charge of the promoted post, meaning that no financial arrear will be admissible to them for the period from the date on which they get the benefit of notional promotion and the date on which they actually assume or have already assumed the charge of such promoted post.

(iii) Extending the benefit of reservation in promotion to the PwD employees on notional basis between 30.6.2016 and actual assumption of the charge of the post may affect the inter-se-seniority of the officials in various grades. Due to this, there may be cases in which some officials may have to be placed in a select list/seniority list, subsequent to the year of their existing/present seniority list/select list. This may have a chain effect as it may result in revision in seniority lists in subsequent years in many cases which may cause administrative inconvenience. In order to avoid such situation, supernumerary posts may be created to adjust the lien of such PwD employees with effect from the date on or after 30.6.2016, when they become eligible to get the benefit of reservation in promotion, till the availability of vacancy in which the promotion is to be made or till they vacate the post on their retirement, further promotion etc. whichever is earlier.

(iv) The creation of supernumerary post, as stated above, will be personal to the PwD employee who is given the benefit of reservation in promotion on notional basis and such supernumerary post will stand abolished on the date when such PwD employee is adjusted against available vacancy in the grade in which the promotion is given or when that PwD employee vacates the post on his/her retirement, further promotion etc., whichever is earlier.

(v) Ministries/Departments are advised to undertake an exercise to ascertain the requirement of supernumerary posts required by them and submit the proposal for creation of posts to the Department of Expenditure through DoPT. Such proposal shall contain the proposal in respect of the entire Department/Ministry and the proposal in piecemeal shall not be accepted. A certificate to the effect that the proposal is complete in all respects and the requirement of creation of supernumerary posts has been projected in respect of the entire Department may also be furnished along with the proposal. Further, each proposal shall have the concurrence of the Liaison Officer for PwDs of the Department/Ministry concerned and shall be forwarded with the approval of the Secretary of the Administrative Department/Ministry.

(vi) It is clarified that the benefit of notional promotion, as proposed above, shall not adversely affect those PwD candidates who have already been granted the benefit of reservation in promotion in personam in pursuance of the Orders/judgements of various Courts of Law.

6. This issues with the approval of Department of Expenditure conveyed vide their ID Note No.7(1)/E. Coord.I/2017 Part (V) dated 12.12.2023.

(Debabrata Das)

Under Secretary to the Government of India.

Conversion of NPS to OPS and Constitution of 08th CPC: Prior intimation by BPMS regarding Agitational Programme

Conversion of NPS to OPS and Constitution of 08th CPC: Prior intimation by BPMS regarding Agitational Programme

भारतीय प्रतिरक्षा मजदूर संघ

Bharatiya Pratiraksha Mazdoor Sangh

(AN ALL INDIA FEDERATION OF DEFENCE WORKERS)

(AN INDUSTRIAL UNIT OF B.M.S.)

(RECOGNISED BY MINISTRY OF DEFENCE, GOVT. OF INDIA)

CENTRAL OFFICE : 2-A, NAVIN MARKET, KANPUR-1

REF: BPMS / MOD / AGITATION / 232 (8/3/M)

Dated: 19.12.2023

To,

The Secretary,

Min of Defence, Govt of India,

South Block, New Delhi — 110011

{ Kind attention: Shri Gopal Mehra, US D(JCM)}

Subject: Prior Intimation – Agitation Programme for Conversion of NPS to OPS and Constitution of 08th CPC.

Respected Sir,

With due regards, it is submitted that as part of our ongoing efforts to address the concerns of our members, the National Executive Committee of BPMS recently convened a meeting on 16 & 17 December at MSF Estate Ichapur (W.B.). During this meeting, a decision was taken to conduct two agitation programmes to address critical issues affecting government employees.

Agitation Programme Details:

Objective:

- Demand the constitution of the 08th Central Pay Commission (CPC) for government employees.

- Demand the conversion of NPS to OPS for those 7354 employees who are recruited in Ordnance & Ordnance Equipment Factories on or after 01.01.2004 against the vacancies sanctioned by Min of Defence vide File No. 1640/D(QA)/2002, dated 20.05.2003 for direct recruitment.

Activities:

- Slogan Shouting, Gate Meetings, Dharna, Mass Demonstration.

- A memorandum regarding the conversion of NPS to OPS will be submitted to your esteemed office on 10.01.2024, through the respective Head of Establishments of Ordnance & Ordnance Equipment Factories.

- A detailed memorandum outlining the concerns and demands regarding the constitution of the 08th CPC will be submitted to the Finance Minister, Govt of India, on 19.01.2023, through the Head of Establishments of all the Defence Installations.

We understand the significance of these matters and the impact they have on the lives of our fellow employees. Our intent is to seek your support and cooperation in addressing these issues for the well-being and financial security of the affected personnel.

Your attention and consideration of these matters are highly appreciated. We look forward to a positive response and remain at your disposal for any further information or discussion.

Thank you for your time and understanding.

Brotherly yours

(MUKESH SINGH)

General Secretary/BPMS &

Member, JCM-II Level Council (MOD)

NC JCM 62nd Meeting Minutes dated 26th December 2023 - reg

NC JCM 62nd Meeting Minutes dated 26th December 2023 - reg

Applicability of GST on late fees / default fees / interest collected on late payment of PLI /RPLI premia - Dte Clarification dtd 28/12/2023

Applicability of GST on late fees / default fees / interest collected on late payment of PLI /RPLI premia - Dte Clarification dtd 28/12/2023

Annual Increment Day 1st Jan 2024 for Central Government Employees

Annual Increment Day 1st Jan 2024 for Central Government Employees

Two Dates for Increment

CCS Rules 9 and 10 of Increment

15 of FR 26 Rules

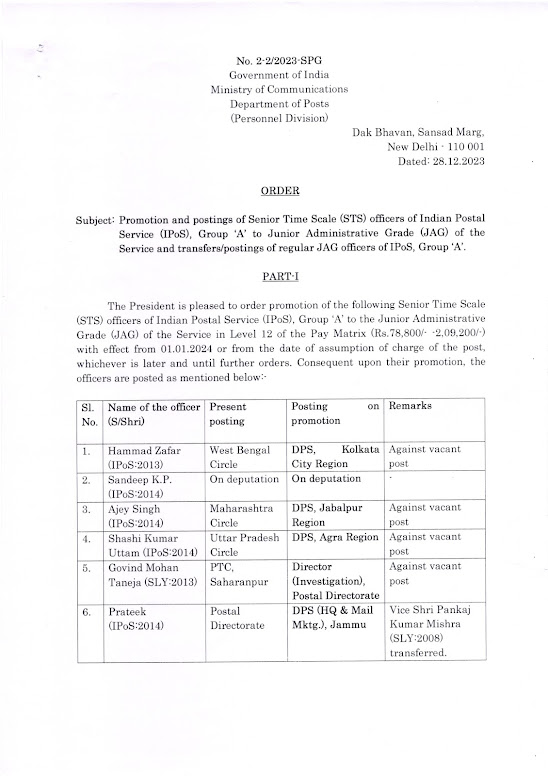

Promotion / Transfers/ Postings of to Junior Administrative Grade (JAG) officers of IPoS, Group "A" - Directorate Order dtd 28/12/2023

Promotion / Transfers/ Postings of to Junior Administrative Grade (JAG) officers of IPoS, Group "A" - Directorate Order dtd 28/12/2023

%20to%20HSG-I%20cadre-I.jpg)

%20to%20HSG-I%20cadre-II.jpg)

→

→