Revision of CPI-IW index with base year 2016=100. BPS represents to MOS (I/C) M/O Labour & Employment

Saturday 31 October 2020

Computing Dearness Allowance based on new series of CPI and PDS prices is arbitrary, unilateral and anti-employees decision: Confederation

Computing Dearness Allowance based on new series of CPI and PDS prices is arbitrary, unilateral and anti-employees decision: Confederation

CONFEDERATION OF CENTRAL GOVT. EMPLOYEES & WORKERS

1st Floor, North Avenue PO Building, New Delhi — 110001

PRESS STATEMENT

Dated: 28.10.2020

Confederation of Central Government Employees and workers notes with distress that the Government has made yet another attempt to depress the wages of the workers this time in the organised sector. The indexation of wages and the consequent grant of compensatory allowance had been the product of bitter and prolonged struggles of the workers. The present system of computing the dearness compensation, though varies from sector to sector, is based on the consumer price index brought out in stipulated periodicity by the Ministry of Labour. There had been varied and wide ranging criticism over the manner and methodology adopted in the computation of the index figures. Instead of addressing those genuine and legitimate deficiencies, the Government has gone now to create a new series which would further accentuate those very defects to the utter disadvantage of the workers. It is all the more deplorable as the Government has chosen the pandemic days to usher in the new series of CPI.

The Government will bring out the new series with 2016 as the base year. 2016, in so far as Indian economy is concerned, is an extremely extra ordinary year when the economic activities almost came to a grinding halt over the grand declaration of demonetisation. It is an established dictum that base year selected must be a normal year, sans political, social and economic upheaval. Why then 2016, has no logical explanation.

The Government has also decided to change the components of the basket. Post justification had been an afterthought, conceived to cover up. Had there been a consultation with the stake holders, many of the controversies that have arisen could have been avoided. By depressing the food content in the basket, the lower rung in the working class will lose out more. In the past, the base year change used to be effected once after two decades. Why then the periodicity was reduced and bring out a new series now begs reasoned explanation.

Another important decision that would further depress the dearness compensation to the workers is that the Government has chosen the PDS prices of the commodities for computation. Universal PDS was disbanded when the new liberal economic policies were ushered in years back. The present truncated PDS targets only a segment of the population and most of the Central Government employees are excluded from the PDS in almost all States in the country. This apart the prices of the commodities sold in the PDS is highly subsided. Consequently, the prices of commodities included in the basket are nothing but imaginary and often below even the cost of production of such items. Since dearness compensation as an accretion to wages is available for the workers in the organised sector, the new series will bring about drastically reduced salary packet. The Centrals Government employees especially will lose out heavily once the new series are put in operation, which is announced to be with effect from September, 2016 onwards.

On the advice of the Technical Advisory committee, the geometrical mean will be employed instead of the arithmetical average . The conversion factor of 2.88 is devised possibly without taking this factor into account. The conversion factor will be employed in the case of Central Government employees for a very long time to come from September, 2020 onwards. The ruling class was always opposed to the grant of dearness compensation, rather the very concept itself. In the long run, they want the wages to remain static and the prices dynamic to ensure that the Corporates are happy. The resentment against this arbitrary, unilateral and anti-employees decision must be manifested by the increased participation of the Central Government employees in the ensuing one day general strike slated for 26th November,2020, which is organised by the Central Trade Unions on behalf of the Indian working class.

R.N. PARASHAR

SECRETARY GENERAL

Source: Confederation

Friday 30 October 2020

Merger of Regional Rural Banks: Seven RRBs into three –

Merger of Regional Rural Banks: Seven RRBs into three – Reserve Bank of India Notification

Merger of Regional Rural Banks :

Punjab Gramin Bank, Malwa Gramin Bank and Sutlej Gramin Bank into a single RRB as Punjab Gramin Bank,

Assam Gramin Vikash Bank and Langpi Dehangi Rural Bank into a single RRB as Assam Gramin Vikash Bank

Baroda Gujarat Gramin Bank and Dena Gujarat Gramin Bank into a single RRB as Baroda Gujarat Gramin Bank

RESERVE BANK OF INDIA

NOTIFICATION

New Delhi, the 27th July, 2020

DOR.CO.RRB.No. 138/31.04.002/2020-21 .-Whereas the Central Government in exercise of the powers conferred by sub-section (1) of section 23A of the Regional Rural Banks Act, 1976, has vide:-

1. Notification no. S.O. 6255 (E) dated December 21, 2018, amalgamated Punjab Gramin Bank, Malwa Gramin Bank and Sutlej Gramin Bank (hereinafter referred to as “the transfer or Regional Rural Banks”) into a single Regional Rural Bank, which shall be called as Punjab Gramin Bank (hereinafter referred to as “the transferee Regional Rural Bank”), with its head office at Kapurthala , with effect from January 1, 2019 ;

2. Notification no. S.O. 985(E) dated February 22, 2019, amalgamated Assam Gramin Vikash Bank and Langpi Dehangi Rural Bank (hereinafter referred to as “the transferor Regional Rural Banks”) into a single Regional Rural Bank, which shall be called as Assam Gramin Vikash Bank (hereinafter referred to as “the transferee Regional Rural Bank”), with its head office at Guwahati, with effect from April 1, 2019 ; and

3. Notification no. S.O. 986(E) dated February 22, 2019, amalgamated Baroda Gujarat Gramin Bank and Dena Gujarat Gramin Bank (hereinafter referred to as “the transferor Regional Rural Banks”) into a single Regional Rural Bank which shall be called as Baroda Gujarat Gramin Bank (hereinafter referred to as “the transferee Regional Rural Bank”), with its head office at Vadodara, with effect from April 1, 2019.

In furtherance of the above, in exercise of the powers conferred under clauses (a) and (b) of sub-section (6) of section 42 of the Reserve Bank of India Act, 1934 (hereinafter referred to as “the RBI Act”), the Reserve Bank of India, hereby, directs the exclusion of the aforesaid transfer or Regional Rural Banks from the second schedule of RBI Act and the inclusion of the aforesaid transferee Regional Rural Banks in the second schedule of the RBI Act.

LILY VADERA , Executive Director

[ADVT-III/4/Exty ./302/2020-21]

Inclusion/ Exclusion of the Regional Rural Banks: Reserve Bank of India Notification

Inclusion/ Exclusion of the Regional Rural Banks: Reserve Bank of India Notification

RESERVE BANK OF INDIA

NOTIFICATION

New Delhi, the 27th July, 2020

DOR.CO.RRB.No. 139 /31.04.002/2020-21 .-In exercise of the powers conferred under clauses (a) and (b) of sub-section (6) of section 42 of the Reserve Bank of India Act, 1934 (hereinafter referred to as “the RBI Act”), the Reserve Bank of India, hereby, directs the exclusion of the Regional Rural Banks indicated below at column no. [A] from the second schedule of the RBI Act and the inclusion of the Regional Rural Banks indicated below at column no. [B] in the second schedule of the RBI Act.

| Name of the erstwhile Regional Rural Banks [A] | Names of new Regional Rural Banks [B] |

| Gramin Bank of Aryavart | Aryavart Bank, Lucknow , Uttar Pradesh |

| Allahabad UP Gramin Bank | |

| Bihar Gramin Bank | Dakshin Bihar Gramin Bank, Patna, Bihar |

| Madhya Bihar Gramin Bank | |

| Vananchal Gramin Bank | Jharkhand Rajya Gramin Bank, Ranchi, Jharkhand |

| Jharkhand Gramin Bank | |

| Pragathi Krishna Gramin Bank | Karnataka Gramin Bank, Ballari, Karnataka |

| Kaveri Grameena Bank | |

| Narmada Jhabua Gramin Bank | Madhya Pradesh Gramin Bank, Indore, Madhya Pradesh |

| Central Madhya Pradesh Gramin Bank | |

| Sarva U.P. Gramin Bank | Prathama U.P. Gramin Bank, Moradabad , Uttar Pradesh |

| Prathama Bank | |

| Pandyan Grama Bank | Tamil Nadu Grama Bank, Salem, Tamil Nadu |

| Pallavan Grama Bank |

LILY VADERA , Executive Director

[ADVT-III/4/Exty ./301/2020-21]

DOPT REFORMS REGARDING CHILD CARE LEAVE

DOPT REFORMS REGARDING CHILD CARE LEAVE

Ministry of Personnel, Public Grievances & Pensions

DoPT reforms regarding Child Care Leave

Posted On: 26 OCT 2020 7:11PM by PIB Delhi

While briefing about some of the major reforms brought by Department of Personnel & Training (DoPT) under the Modi government, Union Minister of State (Independent Charge) Development of North Eastern Region (DoNER), MoS PMO, Personnel, Public Grievances, Pensions, Atomic Energy and Space, Dr Jitendra Singh said today that the male employees of the government are also now entitled to Child Care Leave.

However, Dr Jitendra Singh said that the provision and privilege of Child Care Leave (CCL) will be available only for those male employees who happen to be “single male parent”, which may include male employees who are widowers or divorcees or even unmarried and may therefore, be expected to take up the responsibility of child care as a single - handed parent.

Describing it as a path-breaking and progressive reform to bring ease of living for government servants, Dr Jitendra Singh said, the orders regarding this had been issued quite some time back but somehow did not receive enough circulation in the public.

In a further relaxation to this provision, Dr Jitendra Singh informed that an employee on Child Care Leave may now leave the head quarter with the prior approval of Competent Authority. In addition, the Leave Travel Concession (LTC) may be availed by the employee even if he is on Child Care Leave. Elaborating further, he informed that Child Care Leave can be granted at 100% of leave salary for the first 365 days and 80% of leave salary for the next 365 days.

Based on the inputs over a period of time, Dr Jitendra Singh said, another welfare measure introduced in this regard is that in case of a disabled child, the condition of availing Child Care Leave up to the age of 22 years of the child has been removed and now Child Care Leave can be availed by a government servant for a disabled child of any age.

With the personal intervention and indulgence of Prime Minister Sh Narendra Modi and his special emphasis on governance reforms, Dr Jitendra Singh said, it has been possible to make several out-of-box decisions in the DoPT over the last six years. Basic purpose behind all these decisions has always been to enable a government employee to contribute to the maximum of his potential, although at the same time there will be no leniency or tolerance toward corruption or non-performance, he said. SNC (Release ID: 1667647)

PRESS STATEMENT.

PRESS STATEMENT.

Dated: 28.10.2020

Confederation of Central Government Employees and workers notes with distress that the Government has made yet another attempt to depress the wages of the workers this time in the organised sector. The indexation of wages and the consequent grant of compensatory allowance had been the product of bitter and prolonged struggles of the workers. The present system of computing the dearness compensation, though varies from sector to sector, is based on the consumer price index brought out in stipulated periodicity by the Ministry of Labour. There had been varied and wide ranging criticism over the manner and methodology adopted in the computation of the index figures. Instead of addressing those genuine and legitimate deficiencies, the Government has gone now to create a new series which would further accentuate those very defects to the utter disadvantage of the workers. It is all the more deplorable as the Government has chosen the pandemic days to usher in the new series of CPI.

The Government will bring out the new series with 2016 as the base year. 2016, in so far as Indian economy is concerned, is an extremely extra ordinary year when the economic activities almost came to a grinding halt over the grand declaration of demonetisation. It is an established dictum that base year selected must be a normal year, sans political, social and economic upheaval. Why then 2016, has no logical explanation.

The Government has also decided to change the components of the basket. Post justification had been an afterthought, conceived to cover up. Had there been a consultation with the stake holders, many of the controversies that have arisen could have been avoided. By depressing the food content in the basket, the lower rung in the working class will lose out more. In the past, the base year change used to be effected once after two decades. Why then the periodicity was reduced and bring out a new series now begs reasoned explanation.

Another important decision that would further depress the dearness compensation to the workers is that the Government has chosen the PDS prices of the commodities for computation. Universal PDS was disbanded when the new liberal economic policies were ushered in years back. The present truncated PDS targets only a segment of the population and most of the Central Government employees are excluded from the PDS in almost all States in the country. This apart the prices of the commodities sold in the PDS is highly subsided. Consequently, the prices of commodities included in the basket are nothing but imaginary and often below even the cost of production of such items. Since dearness compensation as an accretion to wages is available for the workers in the organised sector, the new series will bring about drastically reduced salary packet. The Centrals Government employees especially will lose out heavily once the new series are put in operation, which is announced to be with effect from September, 2016 onwards.

On the advice of the Technical Advisory committee, the geometrical mean will be employed instead of the arithmetical average . The conversion factor of 2.88 is devised possibly without taking this factor into account. The conversion factor will be employed in the case of Central Government employees for a very long time to come from September, 2020 onwards. The ruling class was always opposed to the grant of dearness compensation, rather the very concept itself. In the long run, they want the wages to remain static and the prices dynamic to ensure that the Corporates are happy. The resentment against this arbitrary, unilateral and anti-employees decision must be manifested by the increased participation of the Central Government employees in the ensuing one day general strike slated for 26th November,2020, which is organised by the Central Trade Unions on behalf of the Indian working class.

R.N. PARASHAR

SECRETARY GENERAL.

Thursday 29 October 2020

IT Exemption for payment of deemed LTC fare for non-Central Government employees

IT Exemption for payment of deemed LTC fare for non-Central Government employees

Ministry of Finance

Income-tax Exemption for payment of deemed LTC fare for non-Central Government employees

29 OCT 2020

In view of the COVID-19 pandemic and resultant nationwide lockdown as well as disruption of transport and hospitality sector, as also the need for observing social distancing, a number of employees are not able to avail of Leave Travel Concession (LTC) in the current Block of 2018-21.

With a view to compensate Central Government employees and incentivise consumption, thereby giving a boost to consumption expenditure, the Government of India allowed payment of cash allowance equivalent to LTC fare to Central Government employees subject to fulfilment of certain conditions vide OM No F. No 12(2)/2020-EII (A) dated 12th October 2020. It has also been provided that since the cash allowance of LTC fare is in lieu of deemed actual travel, the same shall be eligible for income-tax exemption on the lines of existing income-tax exemption available for LTC fare.

In order to provide the benefits to other employees (i.e. non-Central Government employees) who are not covered by the above mentioned OM, it has been decided to provide similar income-tax exemption for the payment of cash equivalent of LTC fare to the non-Central Government employees also. Accordingly, the payment of cash allowance, subject to maximum of Rs 36,000 per person as Deemed LTC fare per person (Round Trip) to non-Central Government employees, shall be allowed income-tax exemption subject to fulfilment of conditions specified in para 4.

The income-tax exemption to receipt of deemed LTC fare by a non-Central Government employee (‘the employee’) shall be allowed subject to fulfilment of the following conditions:-

(a) The employee exercises an option for the deemed LTC fare in lieu of the applicable LTC in the Block year 2018-21.

(b) The employee spends a sum equals to three times of the value of the deemed LTC fare on purchase of goods / services which carry a GST rate of not less than 12% from GST registered vendors / service providers (‘the specified expenditure’) through digital mode during the period from the 12th of October, 2020 to 31st of March, 2021 (‘specified period’) and obtains a voucher indicating the GST number and the amount of GST paid.

(c) An employee who spends less than three times of the deemed LTC fare on specified expenditure during the specified period shall not be entitled to receive full amount of deemed LTC fare and the related income-tax exemption and the amount of both shall be reduced proportionately as explained in Example-A below.

The DDOs shall allow income-tax exemption subject to fulfilment of the above conditions after obtaining copies of invoices of specified expenditure incurred during the specified period. Further, as this exemption is in lieu of the exemption provided for LTC fare, an employee who has exercised an option to pay income tax under concessional tax regime under section 115BAC of the Income-tax Act, 1961 shall not be entitled for this exemption.

The clarifications issued by the Department of Expenditure, Ministry of Finance for the Central Government employees vide OM F. No 12(2)/2020-EII (A) Dated 20th October, 2020 and subsequent clarification, if any, issued in this regard shall apply mutatis mutandis to non-Central Government employees also subject to fulfilment of conditions specified in the preceding paras.

The legislative amendment to the provisions of the Income-tax Act, 1961 for this purpose shall be proposed in due course.

Example-A

Deemed LTC Fare : Rs.20,000 x 4 = Rs. 80,000

Amount to be spent : Rs. 80,000 x 3 = Rs. 2,40,000

Thus, if an employee spends Rs. 2,40,000 or above on specified expenditure, he shall be entitled for full deemed LTC fare and the related income-tax exemption. However, if the employee spends Rs. 1,80,000 only, then he shall be entitled for 75% (i.e. Rs. 60,000) of deemed LTC fare and the related income-tax exemption. In case the employee already received Rs. 80,000 from employer in advance, he has to refund Rs. 20,000 to the employer as he could spend only 75% of the required amount.

PIB

Direct Recruitment to IP Cadre through CGLE, 2020 by SSC

Direct Recruitment to IP Cadre through CGLE, 2020 by SSC

SB Order No 35/2020 : Regarding supply of specimen of various forms to be used in operation of National (Small) Savings Schemes in Hindi and English

SB Order No 35/2020 : Regarding supply of specimen of various forms to be used in operation of National (Small) Savings Schemes in Hindi and English

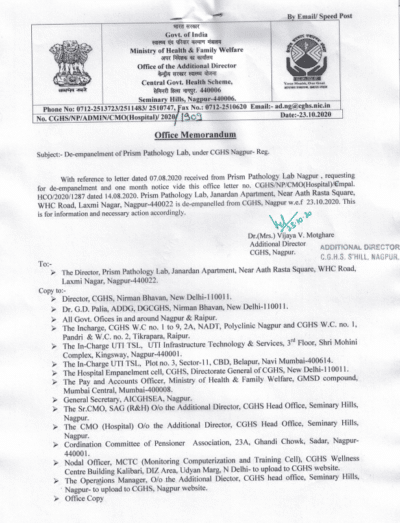

CGHS Nagpur: De-empanelment of Prism Pathology Lab w.e.f 23 Oct 2020

CGHS Nagpur: De-empanelment of Prism Pathology Lab w.e.f 23 Oct 2020

Govt. of India

Ministry of Health & Family Welfare

Office of the Additional Director

Seminary Hills, Nagpur-440006

No. CGHS/NP/ADMIN/CMO/Hospital/2020/1909

Dated: 23.10.2020

Office Memorandum

Subject:- De-empanelment of Prism Pathology Lab, under CGHS Nagpur- Reg.

With reference to letter dated 07.08.2020 received from Prism Pathology Lab Nagpur, requesting for de-empanelment and one month notice vide this office letter no. CGHS/NP/CMO(Hospital)/Empal. HCO/2020/1287 dated 14.08.2020. Prism Pathology Lab, Janardan Apartment, Near Aath Rasta Square, WHC Road, Laxmi Nagar, Nagpur-440022 is de-empanelled from CGHS, Nagpur w.e.f 23.10.2020. This is for information and necessary action accordingly.

Dr.(Mrs.) Vijaya V. Motghare

Additional Director

CGHS, Nagpur

Wednesday 28 October 2020

Clarification regarding issuance of ATM Cards to Joint Account holders

Clarification regarding issuance of ATM Cards to Joint Account holders

Sale of Indian Postal Orders (IPOs) in Branch Post Offices

Sale of Indian Postal Orders (IPOs) in Branch Post Offices

Tuesday 27 October 2020

Pension A Property U/Article 300 And A Fundamental Right To Livelihood U/Article 21: Bombay HC

Pension A Property U/Article 300 And A Fundamental Right To Livelihood U/Article 21: Bombay HC

Shri Naini Gopal Vs The Union of India and Ors. in Case No. – LD-VC-CW-665 of 2020 has minced no words to hold that: We need to remind the Bank that the pension payable to the employees upon superannuation is a property under Article 300-A of the Constitution of India

It is quite remarkable, most reassuring and so refreshing to note that the Nagpur Bench of Bombay High Court just recently on August 20, 2020 in a latest, landmark and laudable judgment titled Shri Naini Gopal Vs The Union of India and Ors. in Case No. – LD-VC-CW-665 of 2020 has minced no words to hold that:

We need to remind the Bank that the pension payable to the employees upon superannuation is a ‘property’ under Article 300-A of the Constitution of India and it constitutes a fundamental right to livelihood under Article 21 of the Constitution of India. The deprivation, even a part of this amount, cannot be accepted, except in accordance with and authority of law. Shri Naini Gopal, the octogenarian filed the petition after more than Rs 3.26 lakh was deducted from his account. The Nagpur Bench of Bombay High Court imposed a cost of Rs 50,000 on State Bank of India for deducting more than Rs 3 lakh from the account of the 85-year-old pensioner – Shri Naini Gopal. Very rightly so!

To start with, the ball is set rolling by Justice RK Deshpande who authored this historic judgment for himself and Justice NB Suryawanshi of Nagpur Bench of Bombay High Court in para 2 wherein it is observed about the background of this case that:

The petitioner Naini Gopal S/o Dhirendra Mohan Roy is retired as an Assistant Foreman from the Ordnance Factory at Bhandara with effect from 1-10-1994. The last drawn basic salary of the petitioner was Rs. 2,675/- and the basic pension was fixed at Rs. 1,334/- as on 1-10-1994. Consequent upon increase in the pension and the dearness allowance as per the recommendations of the 5th, 6th and 7th Pay Commissions, the basic pension of Rs. 25,634/- was fixed, for which the petitioner was entitled to and accordingly he was paid.

D-VC-CW-665 of 2020.odt

IN THE HIGH COURT OF JUDICATURE AT BOMBAY

NAGPUR BENCH. NAGPUR

LD-VC-CW-665 OF 2020

Shri Naini Gopal S/o Dhirendra Mohan Roy,

Aged About 85 Years, Occupation – Pensioner,

R/o F-37/B, Central Railway Colony,

Ajni, Nagpur-440 003. … Petitioner

Versus

1. The Union of India,

Ministry of Defence,

Through its Secretary, New Delhi.

2. The Principal Controller of Defence Accounts (Pension),

Office of Principa l Controller of Defence Accounts,

Allahabad, Uttar Pradesh-211014.

3. The General Manager,

State Bank of India,

Centralized Pension Processing Centre,

5th Floor, Premises No.T-651 and T-7 51,

l.T.C. Belapur, CBD Belapur Railway Station Complex,

Navi Mumbai-400 0614.

4. The General Manager,

Ordnance Factory, Bhandara. … Respondents

Shri S.S. Sharma, Advocate for Petitioner.

Smt. Sushma, Advocate for Respondent Nos.l, 2 a nd 4.

Shri M. Anil kumar, Advocate for Respondent No.3.

CORAM : R.K. DESHPANDE & N.B. SURYAWANSHI . II.

Date of Reserving the judgment: 13th August. 2020

Date of Pronouncing the judgment : 20th August. 2020

JUDGMENT (Per R.K. DESHPANDE. I.) :

1. Notice for final disposal of the matter was issued by this Court on 30-7- 20208 and the parties were heard finally by consent. Hence, Rule. The petition is being disposed of finally.

2. The petitioner Naini Gopal S/o Dhirendra Mohan Roy is retired as an Assistant Foreman from the Ordnance Factory at Bhandara with effect from 1-10-1994. The last drawn basic salary of the petitioner was Rs.2,675/- and the basic pension was fixed at Rs.1,334/- as on 1-10-1994. Consequent upon increase in the pension and the dearness allowance as per the recommendations of the 5th, 6th and 7th Pay Commissions, the basic pension of Rs.25,634/- was fixed, for which the petitioner was entitled to and accordingly he was paid.

3. In the month of August 2019, the basic pension a mount of the petitioner was reduced from Rs.25,634/- to Rs.25,250/- with effect from 1-1-2016 and accordingly, the respondent No.3- the Centralized Pension Processing Centre of the State Bank of India, directed recovery of an a mount of Rs.3,69,035/- from the pension payable to the petitioner in the installments of Rs.11,400/-, i.e. /3rd of the monthly pension with effect from 1-8-2019. The deduction of pension was without the consent or knowledge of the petitioner and, therefore, the petitioner filed a n application under the Right to Information Act, 2005 on 1-9- 2019 to know the reason for deduction and details as to the revision of pension during the period 2015-16 and 2016-17. In response to this application, the petitioner received the reply on 20-9- 2019 from the respondent No.3 informing that there was excess payment of pension of Rs.3,69,035/- to the petitioner, which was discovered after making the revised calculations.

4. The petitioner has, therefore, approached this Court challenging such action and seeking further direction to the respondents to restore the position in respect of payment of pension, prevailing prior to the deduction which commenced from 1-8-2019. Reliance is placed upon the communication dated 4-12- 2019 at Annexure-Q to the petition, issued by the Accounts Officer of the employer stating that the pension at the rate of Rs.26,000/- was correctly notified vide 7th CPC PPO No.401199400151 (0101) .

5. Initially, we heard the matter on 30-7-2020, when the following order was passed :

” Hearing was conducted through Video Conferencing and the learned Counsel for the parties agreed that the audio and visual quality was proper.

2) Issue notice for final disposal of the matter, returnable on 10/8/2020.

3) Smt. Sushma, learned Counsel waives service of notice for respondent nos.l , 2 and 4.

4) We have seen the impugned order dated 14/11/2019 issued by the State Bank of India. We are anxious to know as to whether the State Bank of India has acted on its own or on the basis of instructions issued by any other respondent in the matter. If we find that the action of the Bank is without any authority, we will have to impose heavy costs upon the Bank. Apart from this, if the amount is lying with the personal account of the petitioner, we are also surprised to note as to how the Bank is preventing or not permitting the petitioner to withdraw the amount. If any recovery is to be made, it will be open for the employer to make the same in accordance with law.

5) This order be communicated to the learned Counsel appearing for the parties, either on the e-mail address or on WhatsApp or by such other mode, as is permissible in law.”

6. We were under an impression that the respondent No.3- State Bank of India, Medical College Area, Branch Nagpur, where the petitioner holds the pension account No.10387 387888, must have acted on the basis of the instructions issued by the employer of the petitioner. Therefore, we passed an order stating that we are anxious to know as to whether the State Bank of India has acted on its own or on the basis of the instructions issued by the other respondents in the matter. Obviously, the employer is the party-respondent in this petition. We further made it clear that if we find that the action of the Bank is without any authority, we will have to impose heavy costs upon the Bank. It was also expressed that if the a mount is lying with in personal account of the petitioner, how the Bank is preventing or not permitting the petitioner to withdraw the a mount. If the recovery is to be made, it is open for the employer to make the same in accordance with law.

7. In response to this petition, the employer, who is the respondent No.4- the General Manager, Ordnance Factory, Bhandara, has filed an affidavit taking the stand in Paras 1 to 5 as under :

“1. It is humbly submitted that the details of the Petitioner regarding service particulars, retirement date (as stated in the W.P.) are correct as per record.

2. It is humbly submitted that the Respondent No.02 i.e. the PCDA(P), Allahabad has issued revised PPO No.401199400151 (PPO Suffix 0199) (Copy enclosed as Annexure-R/1) dated 08/01/2018 in respect of the Petitioner, Ex Asstt. Foreman, O.F. Bhandara. Revised pension under the said PPO was Rs.25250/ (w.e.f. 01/01/2016) per month.

3. It is humbly submitted that the Respondent No.02 has Suo-moto revised the above said PPO vide PPO No.401199400151 (PPO Suffix 0101) (Copy enclosed as Annexure-R/2) on the basis of Circular No.C-202 dated 06/08/2019 (Copy enclosed as Annexure-R/3) and the pension was fixed to Rs.26,000/- (w.e.f. 01/01/2016).

4. It is humbly submitted that the PPOs are being sent by the Respondent No.02 to Respondent No.03 directly through email.

5. It is humbly submitted that the Respondent No.04 has not issued any order for recovery of any amount from the pension of the Petitioner. “

We have also perused Annexure-Q, which is the communication dated 4-12-2019 by the Accounts Officer from the office of the respondent No.4- employer stating that the pension at the rate of Rs.26,000/- has been correctly notified.

8. We now turn to the reply filed by the respondent No.3- State Bank of India and Paras 4 to 8 being relevant, are reproduced below :

“4. That the Petitioner submits that The pension was further revised from Rs.4,027.00 to Rs.9,102.00 as per the 6th C.P.C. This was payable to the Petitioner as he was a Civil Pensioner, however the respondent bank calculated the same as a Personnel Below Officer Rank (PBOR) and started paying him Rs.9974.00 thus an excess of Rs.872.00 per month from Oct. 2007 erroneously which was due to technical error in the system. It is submitted that there was an corrigendum No.PPG No.C/Corr/6th CPC/04635/2012 and Circular No.102 which was not taken into consideration while making the payments and the bank continued to pay Rs.9974.00 till the subsequent revision. The Copy7 of the Pay Fixation by the Respondent No.2 is filed as Annexure R-1.

5. That the Pension was further revised from Rs.9,102.00 to Rs.25,634.00 as per the 7th CPC which is payable till date. That the Petitioner submits that the basic was Rs.9,102.00 however the Bank paid Rs.9974.00 erroneously and further made enhancement of the Pension on the said erroneously calculated pension which comes to Rs.25,634.00 which was being paid and on having noticed this fact, the Bank has fixed the Pension at Rs.25,250.00 which is as per the guidelines of the respondent No.2 and 4.

6. The respondent has not received any Memo from the respondent No.2 and 4 for enhance of pension to Rs.26,000/- as filed at Page No.92 by the Respondent No.4 and on receipt of the copy of the Petition, the respondent has already taken up the matter with the respondent No.2 on 7.8.2020 vide complaint No.52973 and on receipt of the clarification and appropriate PPO the increased pension if any shall be released as may be advised by the Respondent No.2 and 4.

7. That the Petitioner submits that due to oversight an amount of Rs.3,69,035/- is paid in excess by the answering respondent during the aforesaid period which is being recovered. It is submitted that the respondent No.5 has recovered the said amount over a huge period of time, which can be seen from the fact that the aforesaid recoveries have started from }an. 2006 and till date only Bank has partly recovered the amount and the Bank is yet to recover an amount of Rs.42,042.00 till date and nominal interest thereon.

8. That the respondent submits that in view of the representations made the Bank has not recovered any amount from Dec. 2019 as the Petitioner has informed that he is entitled to Rs.26,000.00 as pension and he is likely to receive sizeable arrears and the remaining amount can be recovered from the said amount, for which bank has sent him various letters however the Petitioner only made correspondences and never met the bank officials for the amicable resolution.”

It is the stand taken by the respondent- Bank that an a mount of Rs.872/- per month was erroneously paid in excess to the petitioner from the October 2007 due to technical error in the system.

9. Reliance is placed upon the Reserve Bank of India Circular No.RBI/2015-16/340-DGBA.GAD.No.2960/45.01 .001/2015-16 dated 17-3-2016, containing clause (c), which is reproduced below :

“c) In case the pensioner expresses his inability to pay the amount, the same may be adjusted from the future pension payments to be made to the pensioners. For recovering the over-payment made to pensioner from his future pension payment in installments 1/3rd of net (pension + relief) payable each month may be recovered unless the pensioner concerned gives consent in writing to pay a higher installment amount.”

On the basis of the aforesaid clause, the Bank claims to have an authority to recover the excess payment made to the pensioner. It is the further stand taken in Para 6 of the reply filed by the Bank that it has not received any Memo from the respondent Nos.2 and 4 for enhancement of pension from Rs.26,000/-, which is referred to as Annexure R-2 in the reply filed by the employer and it is stated that the Bank has already ta ken up the matter with the respondent No.2 on 7-8- 2020 vide complaint No.52973 and on receipt of the clarification and appropriate PRO, the increased pension if any shall be released as may be advised by the respondent Nos.2 and 4.

10. What we find in the present case is that the stand taken by the employer, the competent authority, is very clear and unequivocal in stating that the fixation of pension of the petitioner was correct and proper. The employer has supported the claim of the petitioner and has no role to play in the matter of reduction of pension or its recovery.

The letter dated 4-12- 2019 addressed to the petitioner by the employer states that the pension at the rate of Rs.26,000/- has been correctly notified vide 7th CPC PPO No.401199400151 (0101). We are, therefore, satisfied that the entitlement of the petitioner to the pension was correctly fixed by the competent authority.

11. It is the stand ta ken by the Bank that the revised pension of Rs.9,102/- was payable to the petitioner as a civil pensioner, but the Bank calculated it as Rs.9,974/- as a personnel below officer rank (PBOR) and thus paid an amount of Rs.872/- per month in excess from October, 2007. Though we passed an order on 30-7-2020, reproduced earlier, to know the authority of the Bank to question this, we do not find any response to it in the reply filed, particularly when the Bank was knowing the stand of the employer supporting the claim of the petitioner for pension. We a re of the view that it is not the authority of the Bank to fix the entitlement of the pension a mount of the employees other than the employees of the respondent- Bank. We, therefore, hold that the action of the Bank to reduce the pension of the petitioner is unauthorized and illegal. Furthermore, the Bank has failed to demonstrate any technical error in the calculations.

12. The Bank has placed reliance upon the Reserve Bank of India Circular No. RBl/2015-16/340-DGBA.GAD. No.2960/45 .01.001/2015-16 dated 17-3-2016 to urge that the authority to recover the excess payment is conferred upon it by the Reserve Bank of India. In Para 14 of the reply, the reliance is also placed upon the undertaking, said to have been given by the petitioner to the Bank, permitting the deduction of all such excess a mounts, if so credited in his account due to oversight. The decision of the Apex Court in the case of High Court of Punjab and Haryana and others v. Jagdev Singh, reported in (2016) 14 sec 267, has been relied upon. In our view, once we hold that in fact there was no excess payment made to the petitioner, the question of applicability of the instructions issued by the Reserve Bank of India or the undertaking given by the petitioner does not a rise. Consequently, the decision of the Apex Court in the aforesaid case would also not apply to the facts of the present case.

13. If the Bank had any doubt a bout the correctness of fixation of pension, it should have carried the correspondence with the employer and got the clarification. At least, an explanation in respect of the proposed deduction with retrospective effect from October, 2007 should have been called from the petitioner. This is the bare minimum requirement of the principles of natural justice. No enquiry or investigation is made before taking the action impugned by the Bank. It is for the first time on 7-8-2020, i.e. after issuance of notice by this Court in the present petition, that the Bank started making enquiries and seeking clarifications from the employer of the petitioner in respect of pension and an assurance is given in the reply that the restoration of pension shall be done, as may be advised by the respondent Nos.2 and 4, the employers. This exercise, in our view, should have been carried out prior to effecting the deductions from the pension payable to the petitioner. The entire action of the Bank, in our view, is arbitrary, unreasonable, unauthorized and in flagrant violation of the principles of natural justice and cannot be sustained.

14. The Bank is a trustee of the account of the pensioners, like the petitioner, and has no authority in the eyes of law to dispute the entitlement of the pension payable to the employees, other than those in the employment of the Bank. To tamper with such account and effect the recovery of pension without any authority, is nothing but a breach of trust of the petitioner by the Bank. We should not be understood to have said that even where there is technical error in calculation, other than of entitlement, is committed resulting in excess payment, the Bank cannot recover it. We have already held that no such case is made out here. The petitioner is of 85 years of age and in Para 5 of the petition, it is the claim that he bears a great liability of mentally disabled daughter, aged a bout 45 yea rs, who has to be looked after mentally and physically, and the costly medical treatment is required to be administered. Instead of showing sensitivity to the problems of senior citizens, the Bank has shown the arrogance and the the petitioner was driven from pillar to post to know the reason for deduction of a mount from the pension payable to him. Though we issued notice for final disposal of the matter, keeping in view that the petitioner is a senior citizen and requires immediate attention to his problem, the respondent- Bank has chosen to file only interim submissions on affidavit sworn-in by the Manager, State Bank of India, Medical College Area, Branch Nagpur.

15. The Bank has reduced the pension payable to the petitioner from Rs.9,974/- to Rs.9,102/- per month and the a mount of Rs.872/- per month is said to have been paid in excess to the petitioner, which is being recovered. In fact, an a mount of Rs.3,26,045/- has already been recovered and the recovery of the balance a mount of Rs.42,042/- is proposed to be made. We, therefore, need to direct the Bank to refund the a mount of Rs.3,26,045/- to the petitioner by crediting it in his pension account with interest at the rate of 18% per annum from the date of deduction till the date of crediting such a mount in the account of the petitioner. We have to restrain the Bank from recovering the balance amount of Rs.42,042/- from the pension account of the petitioner. The Bank is required to be directed to pay the costs of Rs.50,000/- to the petitioner towards the expenses of this petition, mental agony and harassment, within a period of eight days from today; failing which, the further costs of Rs.1,000/- for each day’s delay shall have to be imposed.

16. Before parting with this Judgment, we need to remind the Bank that the pension payable to the employees upon superannuation is a ‘property’ under Article 300-A of the Constitution of India and it constitutes a fundamental right to livelihood under Article 21 of the Constitution of India. The deprivation, even a part of this a mount, cannot be accepted, except in accordance with and authority of law. Article 41 of the Constitution of India in the Part IV of Directive Principles of State Policy has created a n obligation upon the State to recognize a right of public assistance in the case of old age, sickness and disablement. Article 46 therein requires the State to promote with special care the economic interests of the weaker sections of the people. In short, the aforesaid provisions of the directive principles of State policy create an obligation upon the State to enact suitable laws, making the provisions to recognize a right of public assistance, to promote economic interests, to protect the life and property of senior citizens, to treat them with respect and dignity and to give wide publicity to it.

17. Unfortunately, the time has come to tell the Bank that the aging is natural process, which leads to weakening of the body and mind. The productivity, working ability and mobility decreases or paralyzes with growing age. The traditional norms, values and culture in the Indian Society demand to treat the senior citizens with respect, dignity and lay stress on providing security, ca re and assistance to them. It becomes a part of the human right of the senior citizens. The senior citizens a re the persons who had shouldered the responsibility of building a nation in general and society or community in particular, while in service. Utilizing their experience in the life and working, the strong shoulders are created of young persons to substitute and rest the responsibility upon them, while demitting the office. The bank officials must realize that tomorrow it may be their turn, upon superannuation, to fight for the pension or post-retiral benefits. The thought process, therefore, to be adopted should be of a person in a situation like the petitioner. The respect, dignity, ca re, sensitivity, assistance and security would automatically follow.

18. We have, however, seen and can take judicial note of the fact that the security of the senior citizens always remain in peril. We have seen the senior citizens anxiously waiting for credit of the pension amount in their account and standing in a queue for withdrawal. Once the a mount is withdrawn personally either from the Bank or from the ATM, a serious threat starts posing to the life from the watchdogs roaming a round involved in pick-pocketing and stealing. We have actually seen the old aged persons – men and women, counting the currency with cramping hands and trying to secure the a mount at some hidden place in the body. It is then after waiting in the premises of the Bank and ta king stock of the situation and the atmosphere with scared mind and the feeling of insecurity, the escape route and time is chosen to reach to their destination safely. It is a high time for the Banks to create a separate cell and to device a method to provide persona l service through the men of confidence, at the door-step to the old aged, disabled and sick persons who are the senior citizens. They have to be treated with respect and dignity. The sensitivity to the problems of the senior citizens need to be addressed. The mechanism for immediate redressal of grievance needs to be provided. The officers having a degree or master’s degree in Social Work or Psychology, who ca n be in personal touch with and genuinely understand and redress the grievances or complaints of the senior citizens, can be appointed.

19. In the result, this petition is allowed and the following order is passed :

(i) The action of the respondent No.3- Bank in deducting an amount of Rs.11,040/- per month with effect from October, 2019 is hereby quashed and set aside.

(ii) We direct the respondent No.3- Bank to immediately credit an a mount of Rs.3,27,045/-, recovered from the pension account of the petitioner, along with interest at the rate of 18% per annum from the date of recovery of each of the installments, till the date of credit of this a mount in the pension account of the petitioner.

(iii) The respondent No.3- Bank is restrained from recovering any amount from the pension payable to the petitioner on the basis of the action, which we have quashed and set aside.

(iv) We direct the respondent No.3- Bank to pay the compensation of Rs.50,000/- to the petitioner and credit the said amount in the pension account of the petitioner within a period of eight days from today, failing which the additional costs of Rs.1,000/- for each day’s delay will have to be paid.

(V) We direct the Registry of this Court to forward the copies of this judgment to the Centralized Processing Pension Centres of all the Nationalized Banks and also to the Reserve Bank of India and the Chief Secretary, Government of Maharashtra, to consider the question of constitution of separate cell and release of appropriate guidelines so as to attain the constitutional goal of providing respect, dignity, care, sensitivity, assistance and security to all the pension account holders in the Banks.

(vi) This Judgment be uploaded under the digital signature of the Private Secretary.

20. Rule is made absolute in the aforesaid terms. No order as to further costs.

(N.B. SURYAWANSHI. I.) (R.K. DESHPANDE. I.)

Lanjewar , PS

Prashant Lanjewar

Digitally signed by Prashant Lanjewar

Date: 2020.08.20

→

→