Saturday 30 April 2022

147 - Whether charges can be dropped on the stage of initial written statement of defence?

147 - Whether charges can be dropped on the stage of initial written statement of defence?

DIFFICULTIES FACED BY SERVING EMPLOYEES AND PENSIONERS IN RESPECT OF CGHS-REG

DIFFICULTIES FACED BY SERVING EMPLOYEES AND PENSIONERS IN RESPECT OF CGHS-REG

CONFEDERATION ADDRESSED TO THE HEALTH SECRETARY

AICPIN for March 2022

AICPIN for March 2022

GOVERNMENT OF INDIA

MINISTRY OF LABOUR & EMPLOYMENT

LABOUR BUREAU

`CLEREMONT’, SHIMLA-171004

DATED: 29 April, 2022

F.No. 5/1/2021-CPI

Press Release

Consumer Price Index for Industrial Workers (2016=100) – March, 2022

The Labour Bureau, an attached office of the M/o Labour & Employment, has been compiling Consumer Price Index for Industrial Workers every month on the basis of retail prices collected from 317 markets spread over 88 industrially important centres in the country. The index is compiled for 88 centres and All-India and is released on the last working day of succeeding month. The index for the month of March, 2022 is being released in this press release.

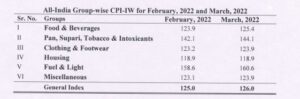

The All-India CPI-IW for March, 2022 increased by 1.0 point and stood at 126.0 (one hundred twenty six). On 1-month percentage change, it increased by 0.80 per cent with respect to previous month compared to an increase of 0.50 per cent recorded between corresponding months a year ago.

The maximum upward pressure in current index came from Food & Beverages group contributing 0.59 percentage points to the total change. At item level, Buffalo-Milk, Cow-Milk, Poultry/chicken, Sunflower oil, Soyabean oil, Palm oil, Apple, Ragi, Peas, Radish, Chili green, Lemon, Potato, Mango, Foreign liquor, Coriander, Cuminikera, Tea Leaf, Saree Cotton, Cooking Gas, Petrol, Telephone/ Mobile Charges etc. are responsible for the rise in index. However, this increase was largely checked by Onion, Tomato, Kundru, Brinjal, Cabbage, Carrot, Cauliflower, Gourd, Egg-Hen, Water melon, Grapes, Beat root, etc. putting downward pressure on the index.

At centre level, Sangrur recorded a maximum increase of 6.3 points followed by Labac-Silchar and Angul-Talchar with 5.8 and 5.4 points respectively. Among others, 2 centres recorded increase between 4 to 4.9 points, 4 centres between 3 to 3.9 points, 8 centres between 2 to 2.9 points, 20 centres between 1 to 1.9 points and 39 centres between 0.1 to 0.9 points. On the contrary, Salem recorded a maximum decrease of 1.1 points. Among others, 11 centres recorded decrease between 0.1 to 0.9 points.

Year-on-year inflation for the month stood at 5.35 per cent compared to 5.04 per cent for the previous month and 5.64 per cent during the corresponding month a year before. Similarly, Food inflation stood at 6.27 per cent against 5.09 per cent of the previous month and 5.36 per cent during the corresponding month a year ago.

The next issue of CPI-IW for the month of April, 2022 will be released on Tuesday, 31st May, 2022. The same will also be available on the office website www.labourbureaunew.gov.in.

(Shyam Singh Negi)

Deputy Director General

Request action to postpone online engagement of GDS to facilitate request transfer of GDS in the existing vacant posts.

Request action to postpone online engagement of GDS to facilitate request transfer of GDS in the existing vacant posts.

Friday 29 April 2022

Conduct & Disciplinary Rules – 115 (Compiled By Com Kayveeyes)

Conduct & Disciplinary Rules – 115 (Compiled By Com Kayveeyes)

The Central Civil Services (Classification, Control & Appeal) Rules, 1965

PART VII – APPEALS

22. ORDERS AGAINST WHICH NO APPEAL LIES:

Notwithstanding anything contained in this Part, no appeal shall lie against-

(i) any order made by the President;

(ii) any order of an interlocutory nature or of the nature of a step-in-aid of the final disposal of a disciplinary proceeding, other than an order of suspension;

(iii) any order passed by an inquiring authority in the course of an inquiry under Rule 14.

23. ORDERS AGAINST WHICH APPEAL LIES:

Subject to the provisions of rule 22, a Government servant may prefer an appeal against all or any of the following orders, namely:-

(i) an order of suspension made or deemed to have been made under rule 10;

(ii) an order imposing any of the penalties specified in rule 11, whether made by the disciplinary authority or by any appellate or revising authority;

(iii) an order enhancing any penalty, imposed under rule 11;

(iv) an order which-

(a) denies or varies to his disadvantage his pay, allowances, pension or other conditions of service as regulated by rules or by agreement; or

(b) interprets to his disadvantage the provisions of any such rule or agreement;

(v) an order-

(a) stopping him at the efficiency bar in the time-scale of pay on the ground of his unfitness to cross the bar;

(b) reverting him while officiating in a higher service, grade or post, to a lower service, grade or post, otherwise than as a penalty;

(c) reducing or withholding the pension or denying the maximum pension admissible to him under the rules;

(d) determining the subsistence and other allowances to be paid to him for the period of suspension or for the period during which he is deemed to be under suspension or for any portion thereof;

(e) determining his pay and allowances-

(i) for the period of suspension, or

(ii) for the period from the date of his dismissal, removal or compulsory retirement from service, or from the date of his reduction to a lower service, grade, post, time-scale or stage in a time-scale of pay, to the date of his reinstatement or restoration to his service, grade or post; or

(f) determining whether or not the period from the date of his suspension or from the date of his dismissal, removal, compulsory retirement or reduction to a lower service, grade, post, time-scale of pay or stage in a time-scale of pay to the date of his reinstatement or restoration to his service, grade or post shall be treated as a period spent on duty for any purpose.

EXPLANATION- In this rule-

(i) the expression 'Government servant' includes a person who has ceased to be in Government service;

(ii) the expression 'pension' includes additional pension, gratuity and any other retirement benefits.

24. APPELLATE AUTHORITY:

(1) A Government servant, including a person who has ceased to be in Government service, may prefer an appeal against all or any of the orders specified in Rule 23 to the authority specified in this behalf either in the Schedule or by a general or special order of the President or, where no such authority is specified-

(i) where such Government servant is or was a member of a Central Service, Group ‘A’ or Group ‘B’ or holder of a Central Civil Post, Group ‘A’ or Group ‘B’ -

(a) to the appointing authority, where the order appealed against is made by an authority subordinate to it; or

(b) to the President where such order is made by any other authority;

(ii) where such Government servant is or was a member of a Central Civil Service, Group ‘C’ or Group ‘D’, or holder of a Central Civil Post, Group ‘C’ or Group ‘D’, to the authority to which the authority making the order appealed against is immediately subordinate.

(2) Notwithstanding anything contained in sub-rule (1)-

(i) an appeal against an order in a common proceeding held under Rule 18 shall lie to the authority to which the authority functioning as the disciplinary authority for the purpose of that proceeding is immediately subordinate:

Provided that where such authority is subordinate to the President in respect of a Government servant for whom President is the appellate authority in terms of sub-clause (b) of clause (i) of sub-rule (1), the appeal shall lie to the President.

(ii) where the person who made the order appealed against becomes, by virtue of his subsequent appointment or otherwise, the appellate authority in respect of such order, an appeal against such order shall lie to the authority to which such person is immediately subordinate.

(3) A Government servant may prefer an appeal against an order imposing any of the penalties specified in rule 11 to the President, where no such appeal lies to him under sub-rule (1) or sub-rule (2), if such penalty is imposed by any authority other than the President, on such Government servant in respect of his activities connected with his work as an office-bearer of an association, federation or union, participating in the Joint Consultation and Compulsory Arbitration Scheme.

25. PERIOD OF LIMITATION OF APPEALS:

No appeal preferred under this part shall be entertained unless such appeal is preferred within a period of forty-five days from the date on which a copy of the order appealed against is delivered to the appellant:

Provided that the appellate authority may entertain the appeal after the expiry of the said period, if it is satisfied that the appellant had sufficient cause for not preferring the appeal in time.

Provision for extending benefits under CCS (Pension ) Rules of CCS (EOP) Rules to family of missing Central Government Employees covered under National Pension Scheme (NPS) - reg

Provision for extending benefits under CCS (Pension ) Rules of CCS (EOP) Rules to family of missing Central Government Employees covered under National Pension Scheme (NPS) - reg

Thursday 28 April 2022

Wednesday 27 April 2022

Revised Instruction for constitution and functioning of Local Committees to deal with Taxpayers Grievances from High-Pitched Scrutiny Assessment

Revised Instruction for constitution and functioning of Local Committees to deal with Taxpayers Grievances from High-Pitched Scrutiny Assessment

F.No.225/10112021-ITA-ll

Government of India

Ministry of Finance

Department of Revenue

Central Board of Direct Taxes

********

Room No. 245-A, North Block,

New Delhi, the 23rd April, 2022

To

All Pr. CCsIT/DGsIT/Pr.CCIT(Exemption)/Pr. CCIT(International-tax)

Madam/Sir,

Subject: Revised Instruction for constitution and functioning of Local Committees to deal with Taxpayers Grievances from High-Pitched Scrutiny Assessment -reg.

The Central Board of Direct Taxes (the ‘CBDT’), by its Instruction No.17/2015 dated 09.11.2015 (copy enclosed) provided for constitution of ‘Local Committees to deal with Taxpayers’ Grievances from High-Pitched Scrutiny Assessment’ in each Pr.CCII region. The Local Committees were constituted to expeditiously deal with Taxpayers’ grievances arising from High-Pitched Scrutiny Assessment.

2. Taking into consideration the changes in organizational set-up subsequent to launch of Faceless Assessment regime, the CBDT, in exercise of its powers under section 119 of the Income-tax Act,1961(‘the Act’) and in supersession of its earlier Instruction No. 17/2015 dated 09.11.2015, hereby issues the following instructions regarding constitution and functioning of ‘Local Committees to de.al with Taxpayers’ Grievances from High-Pitched Scrutiny Assessment’:

A. Constitution of Local Committees:

(i) Local Committees to deal with Taxpayers’ Grievances from High-Pitched Scrutiny Assessment (‘Local Committees’) are required to be constituted in each Pr.CCIT region across the country including the Pr.CCIT(Exemption) and Pr.CCIT(Intemational Taxation).

(a) The Local Committee shall consist of 3 members of Pr.CIT/CIT rank. To have a perspective of processes involved in Faceless Assessment process, Local Committees so constituted in each Pr. CCIT region and Pr.CCIT(Exemption) shall have one Pr.CIT (AU) of the region. The Local Committee constituted under the Pr.CCIT (International Taxation) need not have a Pr.CIT(AU) as a member, as the assessments under the International Taxation charges are outside the purview of Faceless Assessment regime.

(b) The other members may be selected from the pool of officers posted as Pr.CsIT/Pr. CIT(Central)/CIT(Judicial)/ CIT(Audit)/CsIT(DR),ITAT of the respective P.CCIT region. For the Local Committees constituted under the Pr.CCIT(Exemption) and Pr.CCIT(International Taxation), members may be selected from their respective pool of officers.

(c) The senior most Member would be designated as the Chairperson of the Committee.

(d) The Addl. CIT (Headquarters) to such Pr. CCIT would act as a Member- Secretary to the Local Committee.

(ii) The Local Committees so constituted may co-opt other members, if necessary.

(iii) The Pr. CCIT concerned should ensure that the Local Committees are duly re-constituted after transfer/promotion of Members of the existing Local Committees.

(iv) Adequate publicity shall be given regarding constitution and functioning of Local Committees for filing of grievance petitions regarding High-Pitch Scrutiny Assessments. The communication address of such Local Committees shall be displayed at prominent places in the office building.

B. Jurisdiction of Local Committees:

The Local Committees constituted as above shall deal with the grievance petitions of the assessees under the jurisdiction ofrespective Pr.CCU regarding High-Pitched Scrutiny Assessments completed under both faceless and non-Faceless Assessment regimes. These Committees constituted in Pr. CCIT Region will also handle the grievances pertaining to Central Charges located under the territorial jurisdiction of the Pr. CCIT concerned.

C. Receipt of Grievances:

(i) Grievances related to High-Pitched Scrutiny Assessments completed under the Faceless Assessment regime will be received by NaFAC through dedicated e-mail id: samadhan.faceless.assessment [at]incometax.gov. in. Grievances so received shall be forwarded to Local Committee of the Pr. CCIT concerned by NaFAC, under intimation to Pr. CCIT of the Region/ Pr.CCIT(Exemption).

(ii) Grievances related to High-Pitched Scrutiny Assessments completed under the non Faceless Assessment regime will be received by the office of Pr.CCIT concerned, physically or through e-mail. Grievances so received shall be forwarded to Local Committee of the Pr. CCIT concerned.

D. Action to be taken by the Local Committees on grievance petitions:

(i) A grievance petition received by the Local Committee would be acknowledged. A separate record would be maintained for dealing with such petitions by the Member Secretary.

(ii) Member – Secretary on receipt of taxpayers’ grievances of High-Pitched Assessment, will forward the same to the Chairman and Members of the Local Committee within three days of receipt of the grievance.

(iii) The grievance petition received by Local Committee would be examined by it to ascertain whether there is a prima -facie case of High-Pitched Assessment, non-observance of principles of natural justice, non-application of mind or gross negligence of Assessing Officer/Assessment Unit.

(iv) The Local Committee may call for the relevant assessment records to peruse from the Jurisdictional Pr.CIT concerned.

(vi) The Local Committee may seek inputs from the Directorate of Systems (ITBA/e filing/CPC-ITR, CPC-TDS, etc.), on Systems-related issues emanating from the grievance/matter under consideration, if considered necessary.

(vii) Local Committee would ascertain whether the addition(s) made in assessment order is/are not backed by any sound reason or logic, the provisions of law have grossly been misinterpreted or obvious and well-established facts on records have outrightly been ignored. The Committee would also take into consideration whether principles of natural justice have been followed by the Assessing Officer/Assessment Unit. Thereafter, Local Committee shall submit a report treating the order as High-Pitched/Not High-pitched, along with the reasons, to the Pr. CCII concerned.

(viii) The Local Committee shall endeavor to dispose of each grievance petition within two months from the end of the month in which such petition is received by it.

(ix) Member- Secretary will ensure that the meetings of the Local Committees are held at least twice in every month during the pendency of the grievance petitions and that timely reports are submitted to the Pr. CCII concerned.

E. Follow up action by Pr.CCIT:

(i) On receipt of the report of Local Committee, Pr. CCIT concerned may take suitable administrative action in respect of cases where assessment was found to be High-Pitched by the Local Committee, which inter-alia include:

a) Calling for explanation of the Assessing Officer/Assessment Unit (through Pr.CCIT,NaFAC) and any other administrative action as deemed fit.

b) Administratively advise the Pr.CIT concerned to prevent any coercive recovery in cases identified as high pitched by the Local Committee.

(ii) The findings of the report of the Local Committee may also be shared by the Pr.CCIT concerned with NaFAC and/or Directorate of Income-tax(Systcms), as feedback, for revisiting the SOP/policy on Faceless Assessment and/or addressing the Systems related issues.

F. Monitoring the functioning of Local Committee:

(i) The Pr. CCIT concerned shall review the work of the Local Committee on a monthly basis. Pr. CCsIT shall highlight outcome of work oLocal Committees along with the action taken on the suggestions made by the Local Committees in respect of cases where assessment were found to be High-Pitched by the Local Committees, in their monthly D.O. letters to the respective Zonal Member.

(ii) Quarterly Report regarding the functioning of Local Committees shall be furnished by the Pr. CCIT concerned to the O/o Member (IT&R), CBDT under intimation to the respective Zonal Member in the prescribed format (copy enclosed) by 15th of the month following the quarter ended.

3. The purpose of constitution of Local Committees is to effectively and efficiently deal with the genuine grievances of taxpayers and help in supporting an environment where assessment orders are passed in a fair and reasonable manner. It is to be noted that Local Committees cannot be treated as an alternative forum to dispute resolution/appellate proceedings.

4. It is emphasized that the task of constitution of Local Committees as per this Instruction be finalized within 15 days of issue of this Instruction or 30.04.2022, whichever is later, and compliance report may be sent by the Jurisdictional Pr. CCsIT/Pr. CCIT (Intl.Tax.)/ Pr.CCIT(Exemptions) to their respective Zonal Members with a copy to Member (IT&R), CBDT.

5. This issues with the approval of Chairman, CBDT.

Enclosure: As above

(Ravinder Maim)

(Director) (ITA-II), CBDT.

Amendment in Model Recruitment Rules for the post of Manager in Non-Statutory Departmental Canteens located in Central Government Offices: DOPT OM dated 26.04.2022

Amendment in Model Recruitment Rules for the post of Manager in Non-Statutory Departmental Canteens located in Central Government Offices: DOPT OM dated 26.04.2022

OFFICE MEMORANDUM

Subject: – Amendment in Model Recruitment Rules for the post of Manager in Non-Statutory Departmental Canteens located in Central Government Offices.

The undersigned is directed to refer to this Department’s O.M. No.-3/2/2009-Dir.(C) dated 04.06.2014 (read with O.M. No- 3/2/2009- Dir.(C) dated 9.2.2015 and O.M. No.-3/1/2021- Dir.(C) dated 19.07.2021) whereby Model RRs for various Group ‘B’ posts in Non-statutory departmental canteens in Central Government Offices were circulated.

2. This Department has received some references regarding amendment in Model RRs to the post of Manager. Accordingly, the provisions of Model RRs for the post of Manager were examined in consultation with Estt. (RR) Division, DoPT and UPSC. It has been decided to amend the RRs to the post of Manager in Non-statutory departmental canteens as under :-

| Sl. No. | Existing Provision | Amended Provision |

| 7. Educational and other qualifications required for direct recruits. | Essential :-

| Essential :- Bachelor’s degree in Commerce / Business — Studies / Economics / Public Administration from a recognized University / Institute: Desirable :- Two years experience in Accounts work in any Government Office or Public Sector Undertaking or Autonomous / Statutory. Organisation. |

3. Ministries/ Departments are requested to take suitable necessary action for amending Recruitment Rules for the post of Manager accordingly.

Source: DOPT

Percentage of Salary Budget allocated for training and capacity building: DOPT OM dated 26.04.2022

Percentage of Salary Budget allocated for training and capacity building: DOPT OM dated 26.04.2022

MOST IMMEDIATE

No. T-16017/21/2022-TFA

Government of India

Ministry of Personnel, Public Grievances and Pensions

Department of Personnel & Training

(Training Division)

**********

Old JNU Campus, New Delhi

Dated the 26th April, 2022

OFFICE MEMORANDUM

Sub: Percentage of Salary Budget allocated for training and capacity building.

The undersigned is directed to say that the National Training Policy 2012 (para 9) has recommended that each Ministry / Department / Organization set aside at least 2.5% of its Salary Budget for training and capacity building.

2. In the meeting held between this Department and NITI Aayog recently, it was decided to analyze the percentage of the overall budget of Ministries / Departments allocated and utilized for training and capacity building.

3. In view of the foregoing, it is requested to kindly share the information, in the enclosed proforma, as regards the percentage of the Salary Budget allocated and utilized for training and capacity building in respect of the Ministry / Department, including various organizations functioning under their administrative control, during the last five years.

4. This may kindly be accorded priority and a softy copy of the requisite information may please be shared at: dramesh.babu@nic.in/ rizwano.bano14@nic.in.

Encl: As above.

Copy to

Source: DOPT

Cabinet approves revised cost estimate on “Setting up of India Post Payments Bank”

Cabinet approves revised cost estimate on “Setting up of India Post Payments Bank”

Additional funding of Rs.820 crore for FY 2020-21 to 2022-23 total outlay now at 2255 crore

The Union Cabinet chaired by the Prime Minister Shri Narendra Modi has approved the revision of project outlay for setting up of India Post Payments Bank (IPPB) from Rs.1435 crore to Rs.2255 crore as equity infusion to meet regulatory requirement. The Cabinet also granted in principle approval for future fund infusion to the tune of Rs.500 crore for meeting regulatory requirements and technological upgradation.

The objective of the project is to build the most accessible, affordable and trusted bank for the common man; spearhead the financial inclusion agenda by removing the barriers for the unbanked and reduce the opportunity cost for the under banked populace through assisted doorstep banking. The project supplement Government of India’s vision of “less cash” economy and at the same time promote both economic growth and financial inclusion.

India Post Payments Bank did a nationwide a launch by on September 1, 2018 with 650 branches/controlling offices. IPPB has enable 1.36 lakh Post Offices to provide banking services and has equipped nearly 1.89 lakh Postmen and Gramin Dak Sevaks with smartphone and biometric device to provide doorstep banking services.

Since the launch of IPPB, it has opened more than 5.25 crore accounts with 82 crore aggregate number of financial transactions with Rs.1,61,811 crore which includes 765 lakh number of AePS transactions worth Rs.21,343 crore. Out of the 5 crore accounts, 77% of accounts are opened in Rural areas, 48% are women customers with around Rs.1000 crore of deposit. Nearly 40 lakh women customers received Direct Benefit Transfer (DBT) into their accounts valued at Rs.2500 crore. More than 7.8 lakh accounts have been opened for school students.

In Aspirational Districts IPPB has opened around 95.71 lakh accounts having 602 lakh aggregate transaction worth Rs.19,487 crore. In Left Wing Extremism (LWE) districts, 67.20 lakh accounts have been opened by IPPB having 426 lakh aggregate transactions worth Rs.13,460 crore.

Total financial expenditure involved under the proposal stands at Rs.820 crore. The decision shall help India Post Payments Bank pursue its objective of furthering financial inclusion across India by leveraging the network of Department of Posts.

*****

DS

(Release ID: 1820520) Visitor Counter : 797

Request action to postpone online engagement of GDS to facilitate request transfer of GDS in the existing vacant posts. - AIGDSU letter to Directorate

Request action to postpone online engagement of GDS to facilitate request transfer of GDS in the existing vacant posts. - AIGDSU letter to Directorate

Tuesday 26 April 2022

145 - Can two penalties be imposed for one lapse/offense?

145 - Can two penalties be imposed for one lapse/offense?

Regarding creation of a new Baramati Postal Division by bifurcation of existing Pune Mfl. Division-MH Circle

Regarding creation of a new Baramati Postal Division by bifurcation of existing Pune Mfl. Division-MH Circle

Postal Directorate has published Annual Report for the year 2021-2022 with full statistical information about the Department of Posts

Postal Directorate has published Annual Report for the year 2021-2022 with full statistical information about the Department of Posts

Regarding printing, collection and handover of passbooks to District Magistrate for account opened under PM CARES for Children Scheme, 2021.

Regarding printing, collection and handover of passbooks to District Magistrate for account opened under PM CARES for Children Scheme, 2021.

_001.jpg)

_002.jpg)

_003.jpg)

→

→