Saturday 30 September 2023

Friday 29 September 2023

AICPIN Figures for August 2023- Press Release

AICPIN Figures for August 2023- Press Release

GOVERNMENT OF INDIA

MINISTRY OF LABOUR & EMPLOYMENT

LABOURBUREAU

Shram Bureau Bhawan, Block No.2,

Institutional Area, Sector 38 (West),

Chandigarh – 160036

Dated: 29th September, 2023

F.No. 5/l/202l-CPl

Press Release

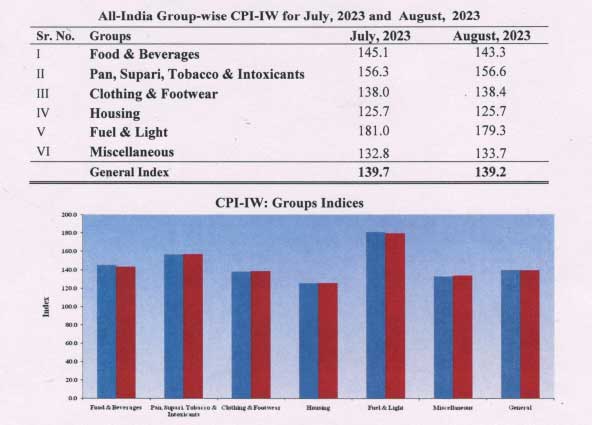

Consumer Price Index for Industrial Workers (2016=100) – August, 2023

The Labour Bureau, an attached office of the M/o Labour & Employment, has been compiling Consumer Price Index for Industrial Workers every month on the basis of retail prices collected from 317 markets spread over 88 industrially important centres in the country. The index is compiled for 88 centres and All-India and is released on the last working day of succeeding month. The index for the month of August, 2023 is being released in this press release.

The All-India CPI-IW for August,2023 decreased by 0.5 points and stood at 139.2 (one hundred thirty nine point two). On 1-month percentage change, it decreased by 0.36 percent with respect to previous month compared to increase of 0.23 per cent recorded between corresponding months a year ago.

The maximum downward pressure in current index came from Food & Beverages group contributing 0.71 percentage point to the total change. At item level, Wheat, Poultry/Chicken, Eggs-hen, Cotton Seed Oil, Apple, Brinjal, Cauliflower, Chillies Green, Ginger, Lady’s Finger, Tomato, Electricity Domestic, Kerosene Oil, etc. are responsible for the faIl in index. However, this decrease was checked by Rice, Arhar Dal, Onion, Cumin Seed/Jira, Cooked Meal, Tailoring Charges, Books School/ITI, Private Tutor/Coaching Centre Fees, Tuition and other Fees-College and School/lTl, Stationery, etc. putting upward pressure on the index.

At centre level, Jaipur recorded a maximum decrease of 4.8 points. Among others, 3 centres recorded decrease between 3 to 3.9 points, 11 centres between 2to 2.9 points, 13 centres between 1 to 1.9 points and22 centres between 0.1 to 0.9 points. On the contrary, Cuttack recorded a maximum increase of 4.4 points followed by Jalandhar with 4.0 points and Dadra & Nagar Haveli and Kollam with 3.7 points each. Among others, 3 centres recorded increase between 2to2.9 points,9 centres between 1 to 1.9 points and 18 centres between 0.1 to 0.9 points. Rest of 4 centres’ indices remained stationary.

Year-on-year inflation for the month stood at 6.91 per cent compared to 1.54 per cent for the previous month and 5.85 per cent during the corresponding month a year before. Similarly, Food inflation stood at 10.06 per cent against 11.87 per cent of the previous month and 6.46 per cent during the corresponding month a year ago.

AICPIN for September 2023

The next issue of CPI-IW for the month of September,2023 will be released on Tuesday, 31st October, 2023. The same will also be available on the office website

All Circle GDS Transfer List - September 2023 released out

All Circle GDS Transfer List - September 2023 released out

The approval of the Competent Authority is hereby conveyed for the GDS Rule-3 transfer (September-2023 Schedule) of the following

Thursday 28 September 2023

CGHS Nomination Facility for Medical Reimbursement on Demise

CGHS Nomination Facility for Medical Reimbursement on Demise

Note : In a Reply to a Recent query of our reader, this 25th September 2013 Order is reposted here

CGHS Nomination Facility for Medical Reimbursement on Demise

Government of India

Ministry of Health & Family Welfare

Department of Health & Family Welfare

Nirman Bhawan, Maulana Azad Road

New Delhi 110108

No. S 11011/12/2013-CGHS (P)

Dated: the 25th September, 2013

OFFICE MEMORANDUM

Sub: Nomination facility under CGHS for claiming medical reimbursement in the event of death of the principal CGHS cardholder – reg.

The undersigned is directed to state that the Ministry has been receiving representations from CGHS beneficiaries to introduce nomination facility whereby a person duly nominated by the principal CGHS cardholder can claim the reimbursement of expenses incurred on the medical treatment of the beneficiary in the event of unfortunate death of the principal card holder.

2.The matter has been examined in this Ministry in the context of difficulties being faced by the family members of a deceased CGHS cardholder in completing the prescribed formalities for claiming reimbursement of medical expenses. Accordingly, it has been decided with the approval of the competent authority to simplify the procedure and provide an option to the principal CGHS cardholder beneficiary to nominate a person to claim reimbursement of medical expenses in the event of his/her unfortunate death.

3.The nomination facility shall be subject to the following conditions:-

a) The nomination facility shall be available only to the CGHS pensioner card holders.

b) Beneficiaries who wish to exercise this option shall submit their declaration of nomination in the prescribed ‘Nomination Form’ duly filled up and complete in all respect, to the CMO In-charge of the CGHS Wellness Centre where the beneficiary is enrolled. [Proforma of Nomination Form enclosed]

c) CMO In-charge shall maintain a separate register ‘ ‘Nomination Register’ to record the particulars of the nomination submitted by the CGHS beneficiary in exercise of this option. Once the nomination details are recorded, the CMO In-charge shall forward the ‘Nomination Form’ to the card issuing authority, i.e., Addl. Director (HQ), CGHS in the case of Delhi and respective Additional{Joint Director, CGHS in the case of other CGHS covered cities for making necessary entries in the CGHS database after due scrutiny and approval of Additional Director, CGHS concerned.

d) The nomination shall be treated as valid only if the same has been entered in the CGHS database.

e) Only one person shall be allowed to be nominated as the original nominee or first nominee. ln addition, another person can also be nominated as ‘alternate nominee or second nominee’ who can claim reimbursement in case of unfortunate death of the first nominee.

f) The principal CGHS cardholder beneficiary can nominate any natural or juristic person as his/her nominee for this purpose, whether related or unrelated to him/ her.

g) This option can be exercised at any time during the lifetime of the beneficiary. However, this option can be exercised only twice in the lifetime of the pensioner card holder.

h) In case, no option has been exercised during the life time of the CGHS pensioner beneficiary, the existing CGHS provision fo1 claiming reimbursement of medical expenses, requiring submission of Affidavit by the claimant and NOCs from other legal heirs shall continue to apply’

4. This Office Memorandum will be effective from the date of its issue”

5. Hindi version will follow’

Encl: Proforma of Nomination Form

(V.P.Singh)

Deputy Secretary to the Government of India

- All Ministries/Departments, Government of lndia

- Director, CGHS, Nirman Bhavan, New Delhi

- AD (Hq), CGHS, Bikaner House, New Delhi

- Addl. DDG (HQ), CGHS, MoHFW, Nirman Bhavan, New Delhi

- All Addl Directors Joint Directors of CGHS cities outside Delhi

- Additional Director (SZ)I (CZ)l(EZ)l (NZ), CGHS, New Delhi

- JD(Gr.){D(R&H), CGHS, Delhi, Bikaner House, New Delhi

- CGHS Desl<- llll/lll/lv, Dte General of CGHS, Nirman Bhawan, New Delhi

- Estt.l /Estt.ll/ Esst. lll/ Estt.lV Section, MoHFW, Nirman Bhavan

10.Admn.l/ Admn.ll Section of Dte. CGHS, Nirman Bhawan, New Delhi - Medical services Division, MoHFW, Nirman Bhawan, New Delhi

- PPS to Secretary (H&FW) Secretary (AYUSH)/Secretary (HR)/Secretary (AIDS Control), Ministry of Health & Family Welfare’ New Delhi

- PPS to DGHS/AS (H)/ AS & DG (CGHS)/AS&MD,NRHM, Ministry of Health & Family Welfare, Nirman Bhawan, New Delhi

- Rajya Sabha/ Lok Sabha Secretariat, Parliament House Annexe, New Delhi

- Cabinet Secretariat, Rashtrapati Bhawan, New Delhi

- Department of Pension & Pensioners’ Welfare, Lok Nayak Bhawan, Khan Market, New Delhi – I l0 003

- Registrar, Supreme Court sf lndia, Bhagwan Das Road, New Delhi

- U.P.S.C, Dholpur House, Shahjahan road, new Delhi

- Integrated Finance Division, Ministry of Health & Family Welfare, Nirman Bhawan, New Delhi

- Deputy Secretary (Civil Service News), Department of Personnel & Training,5th Floor, Sardar Patel Bhawan, New Delhi,

- All Staff Side Members of National Council (JCM) (as per list)

- Office of the Comptroller & Auditor General of India, Bahadur Shah Zafar Marg, New Delhi,

- Sr. Technical Director, NlC, MOHFW, Nirman Bhawan, New Delhi with the request to upload this OM on the CGHS website.

- Executive Director (Health), Railway Board, Rail Bhawan, New Delhi

- Medical Commissioner, ESIC, ESIC Hqrs. Office, Panchdeep Bnawan, C.l.G. Marg, New Delhi-110002

- MD, ECHS, Army Headquarters, AG’s Branch, Maudelines, Delhi Cantt.

- Guard File.

Karmayogi Bharat congratulates the Department of Post

Karmayogi Bharat congratulates the Department of Post Karmayogis on completing over 10 lakh courses, reflecting their commitment to the goal of a Viksit Bharat.

Reply of the department on Strike Notice-

Grant of certificate for deduction of Income-tax at any lower rate or no deduction through TRACES- Procedure, format and standards for filling an application

Grant of certificate for deduction of Income-tax at any lower rate or no deduction through TRACES- Procedure, format and standards for filling an application

Grant of certificate for deduction of Income-tax at any lower rate or no deduction of Income-tax under sub-section (1) of section 197 of the Income-tax Act, 1961 through TRACES – Procedure, format and standards for filling an application under sub-rule (4) and its proviso of Rule 28AA of Income Tax Rules, 1962

F. No. CPC(TDS)/ 197 Certificate/Annex-II/2023-24

Government of India

Ministry of Finance

Central Board of Direct Taxes

Directorate of Income-tax (Systems)

New Delhi

Notification No. 02/2023-Income Tax

Dated: 27th September, 2023

Subject: – Procedure, format and standards for filling an application for grant of certificate under sub-rule (4) and its proviso of Rule 28AA of Income Tax Rules, 1962, for deduction of Income-tax at any lower rate or no deduction of Income-tax under sub-section (1) of section 197 of the Income-tax Act, 1961 through TRACES-reg.

1. As per sub-section (1) of section 197 of the Income-tax Act, 1961(the Act), where, in the case of any income of any person or sum payable to any person, income-tax is required to be deducted at the time of credit or, as the case may be, at the time of payment at the rates in force under the provisions of sections 192, 193, 194, 194A, 194C, 194D, 194G, 194H, 194-I, 194J, 194K, 194LA, [194LBA], 194LBB, 194LBC, 194M, 194-0 and 195, if the Assessing Officer is satisfied that the total income of the recipient justifies the deduction of income-tax at any lower rates or no deduction of income-tax, as the case may be, the Assessing Officer shall, on an application made by the assessee in this behalf, give to him such certificate as may be appropriate.

2. Rule 28 of the Income-tax Rules, 1962 provides for filing an application for grant of certificate for deduction of Income-tax at any lower rate or no deduction of Income-tax under sub-section (1) of section 197 of the Act to be made in Form No. 13 electronically in accordance with the procedures, formats and standards for ensuring secure capture and transmission of data and uploading of documents to be laid down by the Principal Director General of Income-tax (Systems).

3. Proviso to sub-rule (4) of Rule 28AA of the Income Tax Rules, 1962, provides for issuance of certificate for deduction of tax at lower rate, to the person making such application authorizing him to receive income or sum after deduction of tax at lower rate, in cases, where the number of persons responsible for deducting the tax is likely to exceed one hundred and the details of such persons are not available at the time of making application with the person making such application. Sub-rule (6) of Rule 28AA of the Income-tax Rules, 1962, empowers the Director General of Income-tax (Systems) to lay down procedures, formats and standards for issuance of certificates under proviso to sub-rule (4) of Rule 28AA of the Income Tax Rules, 1962.

4. In exercise of the powers conferred under sub-rule (2) of Rule 28 & sub- rule (6) of 28AA of the Income-tax Rules, 1962, the Director General of Income-tax (Systems) hereby specifies the procedure, format and standards for the purpose of electronic filing of Form 13 with Annexure — II and generation of certificate under sub-section (1) of section 197 r.w. proviso to sub-rule(4) of Rule 28AA of Income Tax Rules, 1962 through TRACES as per procedure in the succeeding paragraphs which will be applicable from 01.10.2023.

5. Procedure for electronic filling of Form 13 with annexure-II shall be as follows:

5.1. For making an application in Form 13 with Annexure II the tax- payer/Deducted shall login into the TRACES website (www.tdscpc.gov.in), for grant of certificate for deduction of Income-tax at any lower rate or no deduction of Income-tax under sub-section (1) of Section 197 of the Income-tax Act, 1961.

5.2. The tax-payer/Deducted who is not registered at TRACES website shall have to first register with his Permanent Account Number (“PAN”) at TRACES (www.tdscpc.gov.in) for login and filling application in Form 13 along-with Annexure II. Detailed procedure for registration can be accessed through the link https://contents.tdscpc.gov.in/en/taxpayer-registration-login-etutorial.html

5.3. The tax-payer/Deducted shall login at TRACES website (www.tdscpc.gov.in) and submit the Form No. 13 along-with Annexure II with supporting documents using any of the following, (i) Digital Signature, (ii) Electronic Verification Code, (iii) Aadhar based Authentication, (iv) Mobile OTP.

5.4 Applicants accessing TRACES website from outside of India shall login at TRACES website (www.nriservices.tdscpc.gov.in) and submit application in Form No. 13 along with supporting documents using Digital Signature only.

5.5 The applicant can track the status of the application through option ‘Track Request for Form13/ 15C/ 15D’ under the tab ‘Statements/Forms’.

6. Procedure for assignment of application to the TDS Assessing Officer (AO):

6.1 The application will be assigned to the TDS AO on the basis of details furnished by the applicant in Form 13. Such applications can be accessed by the AO through the path `210 Login->Lower/ No Deduction Certificate-> Generate Certificate->Certificate u/ s 197(1)/206C (9)-> Open Request (s)’.

6.2 For application filed in Delhi, Mumbai, Chennai, Kolkata, Bangalore, Hyderabad, Ahmedabad and Pune, cases where revenue forgone exceeds a sum of Rs. 50 Lakh, the applications shall be assigned to the DCIT/ACIT exercising jurisdiction over TDS matters, and in other cases, the applications shall be assigned to the ITO exercising jurisdiction over TDS matters. If the jurisdiction orders are otherwise, the applications shall be assigned in accordance to such jurisdiction orders.

6.3 For application filed in remaining cities/towns/jurisdictions, the application where revenue foregone exceeds a sum of Rs. 10 Lakh, application shall be assigned to the DCIT/ACIT exercising jurisdiction over TDS matters, and in other cases, the applications shall be assigned to the ITO exercising jurisdiction over TDS matters. If the jurisdiction orders are otherwise, the applications shall be assigned in accordance to such jurisdiction orders.

6.4 Once the application in form 13 has been successfully submitted, the following data will be obtained by CPC-TDS:

(i) Processed data of Income Tax Returns of previous 4 financial years (if available).

(ii) PAN Demand.

(iii) E-filed Income-Tax Returns of previous 4 financial years.

(iv) Audit Report (along with form 3CD if accounts are audited) of previous 4 financial years.

(v) Assessment Orders of previous 4 financial years (if available).

6.5 The applications shall be assigned to the TDS AO exercising jurisdiction over TDS matters in respect of the applicant as explained in para 6.2 and 6.3. However, if the jurisdiction orders are otherwise, the assigned AO can transfer the applications to the AO concerned on AO Portal.

7 Processing of the tax-payer/Dedicatee’s request by the AO, Range Heads and Commissioners of Income-tax:

7.1 Role of AO:

The AO shall process the application through TRACES-AO Portal after login using his/her credentials.

7.1.1 By navigating through the path lower/No Deduction Certificate>Generate Certificate> Certificate us/ 197(1)/206C (9) and select `Open Request (s)’, the AO shall be able to access following information:

(i) Information furnished by the tax-payer/Deductee.

(ii) Documents submitted by the tax-payer/Deductee.

(iii) Information essential for processing the request in respect of the tax-payer/Deductee, as received from other modules.

(iv) Information essential for processing the request in respect of the tax-payer/Deductee, as available at CPC(TDS).

(v) Information about the history of previous TAN less certificate issued to the applicant where the number of dedicators who consumed the said certificate did not reach up to 100 during the last financial year, if available.

7.1.2 If the AO requires any further information or documents or clarification from the applicant for arriving at a decision, the same shall be obtained online using the option “Seek Clarification” available within the functionality through the path ‘AO Login-> Lower/ No Deduction Certificate-> Generate Certificate-> Certificate u/s 197(1)/206C(9)->Open Requests->Request Number->Seek Clarification’.

7.1.3 The query raised by the AO shall be forwarded to the applicant through systems for furnishing a suitable response. The query will be available to the applicant at TRACES Portal through the path ‘Taxpayer Login->Statements/ Forms->Track Request for Form 13/ 15C/ 15D->Request Number->Status->Clanfication required by AO’.

7.1.4 The response submitted by the applicant shall be visible to the AO within the functionality for taking a decision on the application through the path ‘AO Login-> Lower/No Deduction Certificate-> Generate Certificate-> Certificate u/s 197(1)/ 206C(9)->Open Requests->Request Number->Communication History -> Comments’.

7.1.5 Based on the parameters defined in rule 28AA/ 28AB of the Income-tax Rules, 1962 an estimated rate of tax will be suggested by the system functionality. However, the AO shall be free to arrive at independent rate based on his/her method of calculation or by taking into consideration any other information available with him/her. The AO shall allow the deduction at such rate as evidenced in the “Permitted Tax Rate Table” by making any adjustments in respect of the rate, if required. The AO may state the reason for arriving at a modified rate, if so, is the case.

7.1.6 The AO shall approve/reject the application based on the parameters defined in rule 28AA/ 28AB of the Income-tax Rules, 1962 as well as any other instructions/guidelines in this regard.

7.1.7 After approval/rejection of the application, as the case may be, it will be forwarded to the supervisory authority, i.e., the Range Head or Range Head 86 CIT for according administrative approval.

7.2 Role of Range head:

7.2.1 The Range head shall process the application through TRACES-AO Portal after login using their credentials for granting administrative approval to the recommendation of the AO or otherwise.

7.2.2 The Range Head can view the application details, received for administrative approval at TRACES-AO Portal through the path `Range Head Login->Lower/ No Deduction Certificate- > Generate Certificate -> Certificate u/s 197(1)/ 206C(9)->Open Request(s)’. The following information will be available for viewing to the Range Head: (i) Information furnished by the tax-payer/Deductee.

(ii) Documents submitted by the tax-payer/Deductee.

(iii) Information essential for processing the request in respect of the tax- payer/Deductee received from other modules.

(iv) Information essential for processing the request in respect of the tax-payer/Deductee, as available at CPC(TDS).

(v) Information about the history of previous TAN less certificate issued to the applicant where the number of deductors who consumed the said certificate did not reach up to 100 during the last financial year, if available.

(vi) Recommendation of the TDS AO.

7.2.3 If any clarification is required by the Range Head, the application may be sent back to the AO through TRACES — AO Portal. After submission of clarification by the AO through the AO Portal, the Range Head shall take a decision on the application.

7.2.4 After a decision on the application has been taken by the Range Head, if the revenue foregone is within the powers conferred upon the Range Head (as per CBDTs Instructions on the subject) to accord administrative approval, the application will be marked back electronically on TRACES-AO Portal to the AO for issuance of the certificate or rejection of the application. However, if the revenue foregone is within the powers conferred upon the CIT (as per CBDTs instructions on the subject) to accord administrative approval, the application shall be forwarded to the CIT for a decision in the matter.

7.3 Role of the CIT:

7.3.1 The CIT shall process the application through TRACES-AO Portal after login using their credentials for granting administrative approval to the recommendation of the AO/Range Head or otherwise.

7.3.2 The CIT can view the application details, received for administrative approval at TRACES-AO Portal through the path ‘cif Login->Lower/ No Deduction Certificate- > Generate Certificate-> Certificate it/ s 197(1)/206C (9)->Open Request(s)’. The following information will be available for viewing to the CIT:

(i) Information furnished by the tax-payer/Deductee.

(ii) Documents submitted by the tax-payer/Deductee.

(iii) Information essential for processing the request in respect of the tax-payer/Deductee received from other modules.

(iv) Information essential for processing the request in respect of the tax-payer/Deductee, as available at CPC(TDS).

(v) Information about the history of previous TAN less certificate issued to the applicant where the number of deductors who consumed the said certificate did not reach up to 100 during the last financial year, if available.

(vi) Recommendation of the TDS AO.

(vii) Recommendation of the Range Head.

7.3.3 If any clarification is required by the CIT, the application may be sent back to the Range Head through TRACES-AO Portal.

7.3.4 The Range Head may either send back the application to the AO for obtaining the clarification or submit the case to CIT along with the clarifications as required by the CIT through TRACES-AO Portal.

7.3.5 Based on the information available and the report of the Range Head and the AO, the CIT shall take a decision in the case.

7.3.6 After a final decision in the application has been taken by the CIT, the application will be marked back electronically on TRACES-AO Portal to the AO for issuance of the certificate or rejection of the application.

8. Issuance of Certificate:

8.1 On receipt of administrative approval of the competent authority, the AO shall generate a certificate on TRACES-AO Portal through the path ‘AO login->Lower/ No Deduction Certificate-> Certificate u/s 197(1)/206C(9)-> Received from Range Head/ CIT-> Request Number-> Generate Certificate/ Close Request’.

8.2 The issued certificates shall be available to the AO for view through the path ‘Lower / No Deduction Certificate -> History -> Certificate issued’.

8.3 The status of request/application shall be available to the Range Head through the path ‘Range Head login->Lower / No Deduction Certificate-> History-> Certificate Requests’.

8.4 The generated certificates shall be available for download to the applicant on the TRACES through the path Taxpayer login->Downloads-> Download 197, 206C19) or 195(3) Certificate’. The certificate will be system generated and hence will not require a signature.

9. The onus of sharing the certificate to the respective deductor(s) will be on the applicant.

10.Consumption/ Tracking of Certificate:

10.1 The certificate reported by deductor(s) (who have received certificate from the applicant) in the TDS statements, will be consumed on the basis of processing of TDS statements as per FIFO (First in First Out) principle.

10.2 The deductor(s) is/are advised to verify/track consumption status of the certificate before furnishing certificate details in TDS statement(s) through the path Deductor login->Statement / Payments-> History- > Validate Lower Deduction Certificate u/ s 197/ 195(3)/ 195(2)’ to avoid any defaults.

10.3 The consumption status of the certificate can be viewed by the applicant at his login at TRACES website.

11. This issues with prior approval of the Director General of Income-tax (Systems).

(Sunil Sharma)

Addl. Commissioner of Income Tax (CPC-TDS)

O/o The Director General of Income -tax (Systems)

Online NPS Subscriber Registration Module for PRAN generation: CGA OM dated 25.09.2023 for complete rollout in all DDOs under all Ministries/ Departments

Online NPS Subscriber Registration Module for PRAN generation: CGA OM dated 25.09.2023 for complete rollout in all DDOs under all Ministries/ Departments

Online NPS Subscriber Registration Module for PRAN generation: CGA OM dated 25.09.2023 for complete rollout in all DDOs under all Ministries/ Departments (PAO/CDDOs)

F.No.-I-84001/1/2020-ITD-CGA/ces-748/387

Ministry of Finance

Department of Expenditure

Controller General of Accounts

MahalekhaNiyantrak Bhawan

‘E’ Block, GPO Complex, INA,

New Delhi-110023

Dated:25/09/2023

Office Memorandum

Subject: Online NPS Subscriber Registration Module for PRAN generation -reg.

The undersigned is directed to refer to this office OM No. 1-84001/1/2020-ITD-CGA/179-184 dated 12.10.2021 and OM of even No. 224-228 dated 24.11.2021, on the subject cited above.

2. Vide above said OM, it has been decided to pilot run of the employee information system (EIS)-salary module in PFMS with online Subscriber Registration of PRAN generation integration was carried out on select Ministries/Department. The said pilot run was successful.

3. It has, now been decided to complete rollout of NPS- Subscriber Registration Module in all DDOs under all Ministries/Departments (PAO/CDDOs). The user manual has been prepared and is enclosed. EIS help desk (pfms-eis [at] gov.in, Tel. No. 24665-404/405/666) shall handle the queries related to the pilot roll-out.

4. All Pr. CCAs/CCAs/CAs (IC) are hereby requested to direct their PAOs to follow up and actively participate in the complete rollout of NPS- Subscriber Registration Module.

This issues with the approval of competent authority.

(Parul Gupta)

Dy. Controller General of Accounts

The Key to a Better Life

The Key to a Better Life - Article by Shri. Paritosh Thakor

The Key to a Better Life

Time management is basically about being focused. The Pareto Principle also known as the '80:20 Rule' states that 80% of efforts that are not time managed or unfocused generates only 20% of the desired output. However, 80% of the desired output can be generated using only 20% of a well time managed effort. Although the ratio '80:20' is only arbitrary, it is used to put emphasis on how much is lost or how much can be gained with time management.

Some people view time management as a list of rules that involves scheduling of appointments, goal settings, thorough planning, creating things to do lists and prioritizing. These are the core basics of time management that should be understood to develop an efficient personal time management skill. These basic skills can be fine-tuned further to include the finer points of each skill that can give you that extra reserve to make the results you desire.

But there are more skills involved in time management than the core basics. Skills such as decision making, inherent abilities such as emotional intelligence and critical thinking are also essential to your personal growth.

Personal time management involves everything you do. No matter how big and no matter how small, everything counts. Each new knowledge you acquire, each new advice you consider, each new skill you develop should be taken into consideration.

Having a balanced life-style should be the key result in having personal time management. This is the main aspect that many practitioners of personal time management fail to grasp.

Time management is about getting results, not about being busy.

The six areas that personal time management seeks to improve in anyone's life are physical, intellectual, social, career, emotional and spiritual.

1) The physical aspect involves having a healthy body, less stress and fatigue.

2) The intellectual aspect involves learning and other mental growth activities.

3) The social aspect involves developing personal or intimate relations and being an active contributor to society.

4) The career aspect involves your office work.

5) The emotional aspect involves appropriate feelings and desires and manifesting them.

6) The spiritual aspect involves a personal quest for meaning.

Thoroughly planning and having a set of things to do list for each of the key areas may not be very practical, but determining which area in your life is not being giving enough attention is part of time management. Each area creates the whole you, if you are ignoring one area then you are ignoring an important part of yourself.

Personal time management should not be so daunting a task. It is a very sensible and reasonable approach in solving problems big or small.

A great way of learning time management and improving your personal life is to follow several basic activities.

One of them is to review your goals whether it be immediate or long-term goals often.

A way to do this is to keep a list that is always accessible to you.

Always determine which task is necessary or not necessary in achieving your goals and which activities are helping you maintain a balanced life style.

Each and everyone of us has a peak time and a time when we slow down, these are our natural cycles. We should be able to tell when to do the difficult tasks when we are the sharpest.

Learning to say "No". You actually see this advice often. Heed it even if it involves saying the word to family or friends.

To Your Success,

Paritosh Thakor

Wednesday 27 September 2023

Mandatory Capturing of mobile number of sender and addressee at the time of booking of accountable mail

Mandatory Capturing of mobile number of sender and addressee at the time of booking of accountable mail

AIASC (Gr. B) CHQ writes to the Hon'ble Secretary (Posts), New Delhi regarding Central Civil Services (Revised Pay) Rules, 2016 - Opportunity for revision of option to come over to revised pay structure - Clarification Reg.

AIASC (Gr. B) CHQ writes to the Hon'ble Secretary (Posts), New Delhi regarding Central Civil Services (Revised Pay) Rules, 2016 - Opportunity for revision of option to come over to revised pay structure - Clarification Reg.

Tuesday 26 September 2023

Compilation of summaries of important judgements of Supreme Court of India and High Courts across India on Disability Rights

Compilation of summaries of important judgements of Supreme Court of India and High Courts across India on Disability Rights

→

→