Thursday 25 July 2024

Wednesday 24 July 2024

Projected 8th Pay Commission Pay Matrix Table – How much increase ?

Projected 8th Pay Commission Pay Matrix Table – How much increase ?

The 8th Pay Commission, which is yet to be established, must adhere to the Pay Matrix Table developed by the seventh pay commission when it comes to revising Pay Scales and Allowances.

Therefore, the forthcoming Pay Matrix Table of the 8th Pay Commission will be formulated using the same principles that were employed in the development of the Pay Matrix by the 7th Pay Commission

The origin of Pay Matrix Table

The 7th Pay Commission evolved a Pay Matrix in a single page tabular format that includes all the Pay Scale and annual increments of 40 lakh Central Government Employees. It is so simple and convenient to fix the Pay on account of Promotion or calculate, check the Basic pay at any stage without any arithmetic calculation.

Hence forth coming pay commission will have no options than just modifying the Pay matrix table for revision pay.

Projected 8th Pay Commission Pay Matrix Table

Now the 8th Pay Commission, yet to be constituted, has to follow the methods of seventh pay commission in respect of revising Pay Scales in Pay matrix format.

Already we have assumed that the Fitment Factor might be 2.28 in 8th Pay Commission

Accordingly the the cells in all Levels in Pay matrix will be multiplied by 2.28 to arrive Pay matrix for 8th pay Commission. If the 8th Pay Commission decides to go with Pay matrix format for Pay Revision, it will not need much calculation/process for evolving a new format for Pay Scales.

7th Pay Commission pay Matrix and its uniqueness

7th pay commission wanted to simplify the procedure for fixing the pay for Central Government Employees without any calculation. So the Commission had evolved a tabular column with Levels and cells and named it as Pay Matrix

How Pay Matrix Replaced Sixth CPC Pay Structure

At the time of constitution of the VI CPC there were about 35 standard pay scales in existence. Many of these pre revised scales were merged by the VI CPC to arrive at 19 grades spread across four distinct Pay bands along with 4 distinct scales including one Apex scale (fixed) for Secretary/equivalent and one scale for Cabinet Secretary/equivalent (fixed). The concept of Grade pay was intended as a fitment benefit but it also served as a level determiner within a pay band.

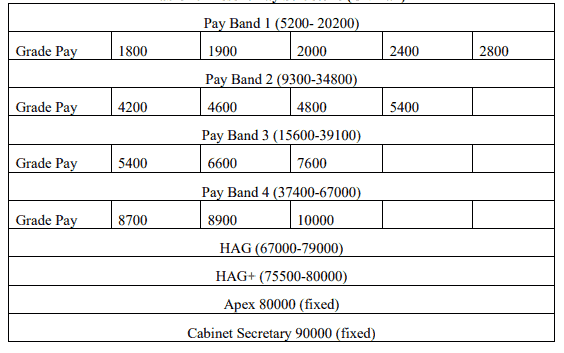

Following implementation of the VI CPC recommendations, the pay structure in the Civilian set up consists of four pay bands with 15 levels of grade pay, along with four standalone scales viz., the HAG scale, HAG+ scale, Apex scale (fixed) and the scale of Cabinet Secretary (fixed) as shown below in Table

The sixth CPC pay Scale

The basics of Pay Matrix

The Commission has designed the new pay matrix keeping in view the vast opportunities that have opened up outside government over the last three decades, generating greater competition for human resources and the need to attract and retain the best available talent in government services. The nomenclature being used in the new pay matrix assigns levels in place of erstwhile grade pay

Prior to VI CPC, there were Pay Scales. The VI CPC had recommended running Pay Bands with Grade Pay as status determiner. The Seventh CPC is recommending a Pay matrix with distinct Pay Levels. The Level would henceforth be the status determiner.

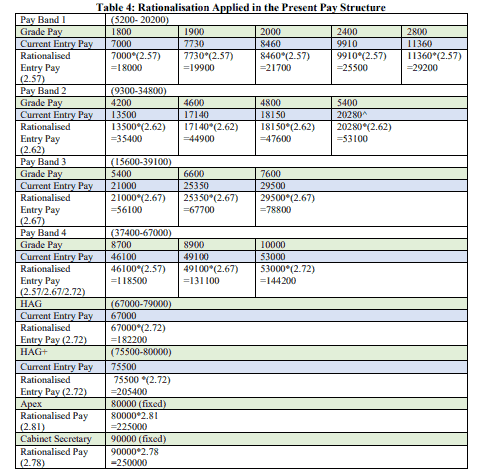

Index of Rationalisation IOR used to differentiate Pay bands

Since the existing pay bands cover specific groups of employees such as PB-1 for Group `C’ employees, PB-2 for Group `B’ employees and PB-3 onwards for Group `A’ employees, any promotion from one pay band to another is akin to movement from one group to the other. These are significant jumps in the career hierarchy in the Government of India. Rationalisation has been done to ensure that the quantum of jump, in financial terms, between these pay bands is reasonable.

This has been achieved by applying ‘index of rationalisation’ from PB-2 onwards on the premise that with enhancement of levels from Pay Band 1 to 2, 2 to 3 and onwards, the role, responsibility and accountability increases at each step in the hierarchy. The proposed pay structure reflects the same principle. Hence, the existing entry pay at each level corresponding to successive grades pay in each pay band, from PB-2 onwards, has been enhanced by an ‘index of rationalisation’ as shown below in Table

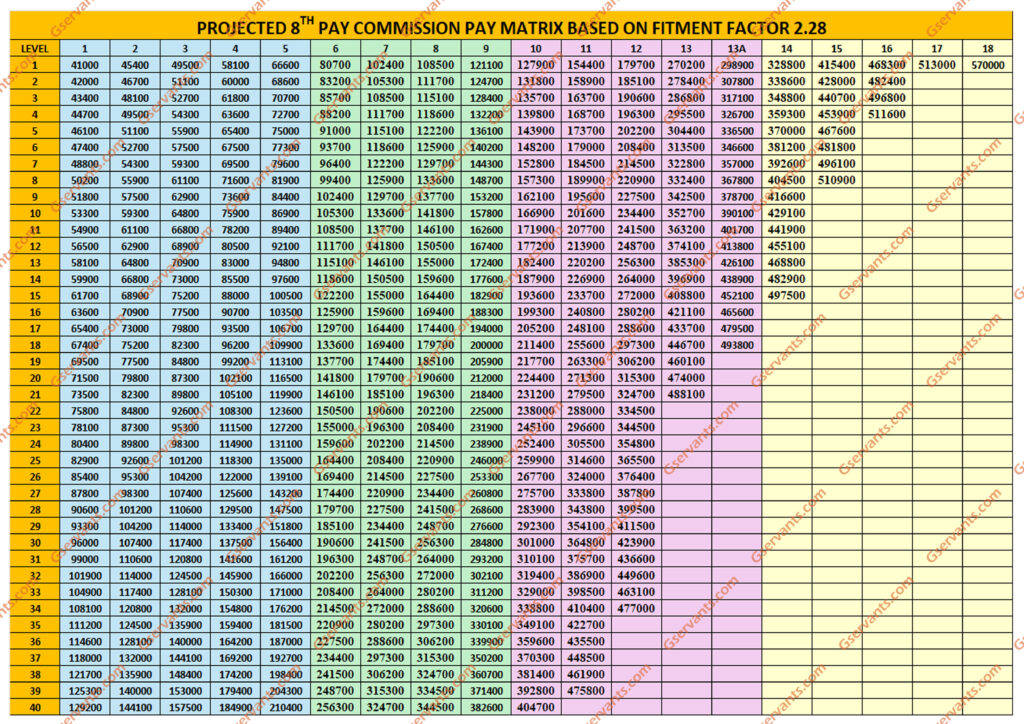

Projected 8th Pay Commission Pay Matrix

The Basics for computing the Projected 8th Pay Commission Pay Matrix is mainly depends on Minimum Pay Increase and Fitment factor

Know Your 8th CPC Pay-Projected 8th pay Commission Pay calculator

The above calculations indicate that the 8th CPC Minimum Pay is set at Rs.41000 and the Fitment Factor stands at 2.28. This information leads to the expected Pay Matrix in the 8th Pay Commission provided below

Since Rationalization of pay as per the classification of Posts has been achieved in 7th CPC, there is no need to use different Fitment factor for the various Levels in 8th CPC

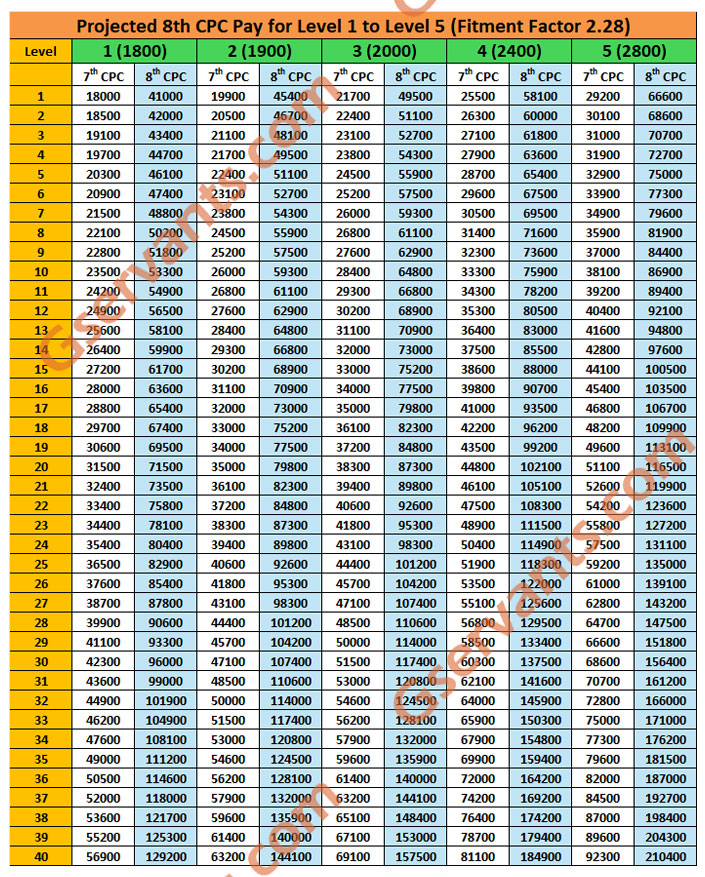

Projected 8th Pay Matrix Table for Level 1 to 5

The Levels 1 to 5 in Pay Matrix which represents erstwhile Grade pay in PB I are arrived by using UMF (Uniform Multiplying factor) 2.28

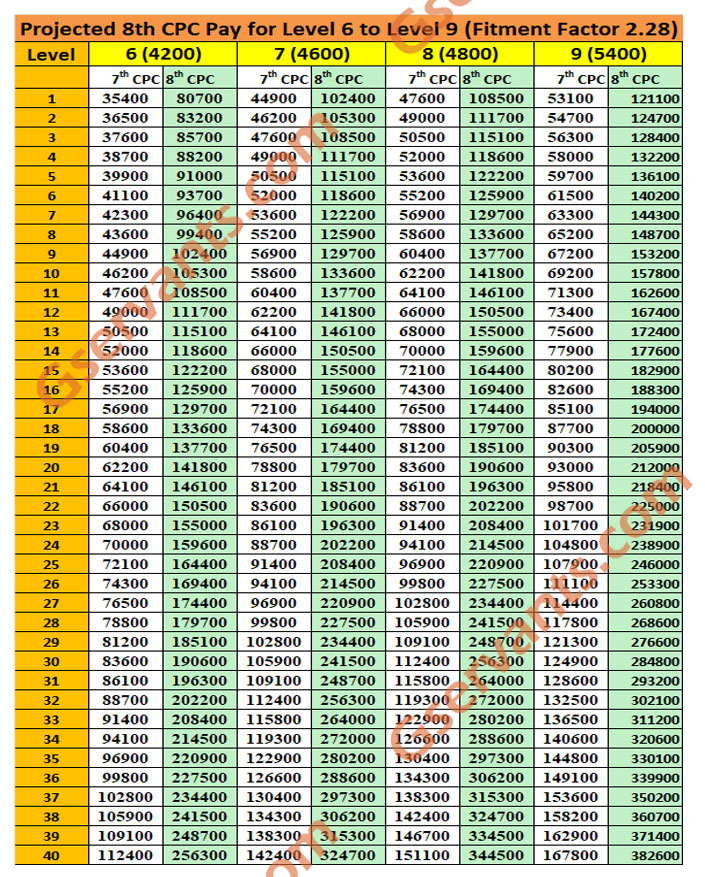

Projected 8th Pay Matrix Table for Level 6 to 9

The pay matrix table for Levels 6 to 9 which replaced the Grade pay in PB II are arrived by using Fitment factor (UMF) 2.28. See the table below

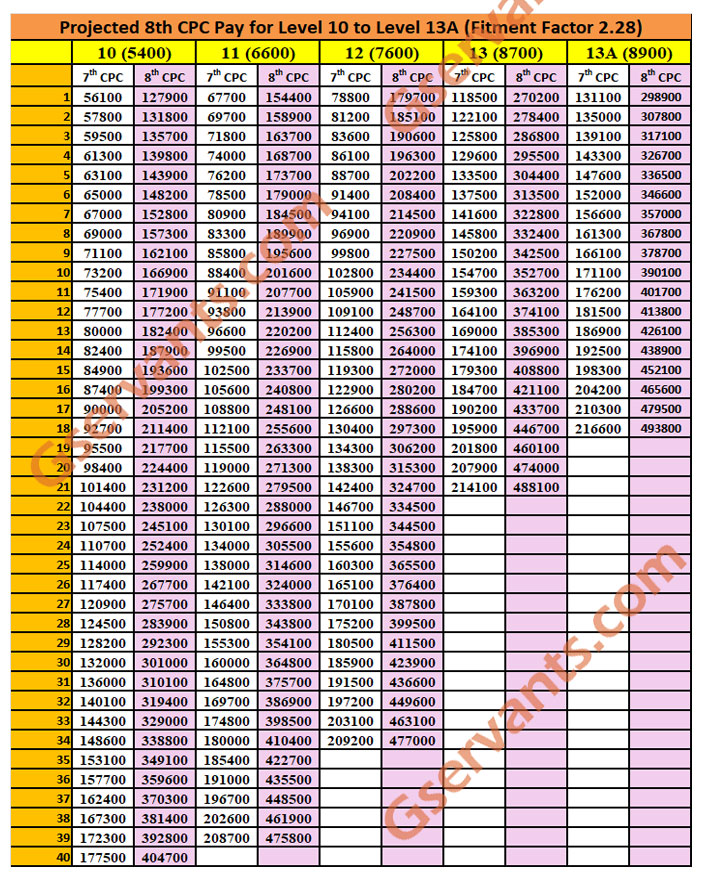

8th Pay Commission Pay Matrix Table for Level 10 to 13A

The Levels from 10 to 13A in Pay Matrix are arrived by using UMF 2.28

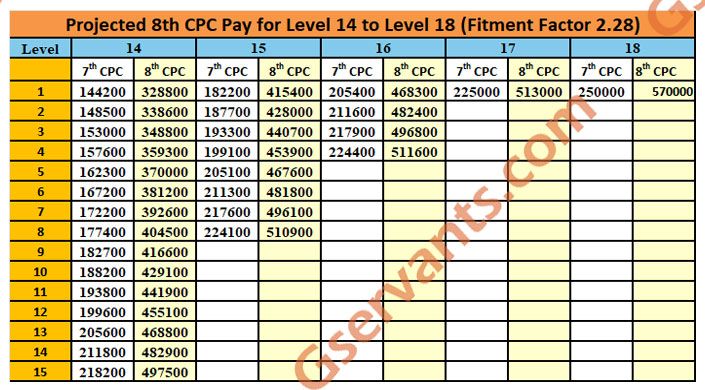

Projected 8th CPC Pay Matrix for Level 14 to Level 18

The Pay Matrix for Level 14 to 18 are calculated by UMF 2.28

Projected 8th Pay Commission Pay Matrix for All Levels

All Levels in Pay Matrix from 1 to 18 are done with Uniform Multiplying factor 2.28 only

In the newly evolved pay matrix for 7th CPC regime, there are 19 levels framed to replace the 19 Grades in Sixth CPC.

Since the this Pay matrix table is user friendly, we expect that 8th Pay Commission will just adopt this for format for pay revision

Retired Employees and Promotions : Impact of Withdrawal of Latest DoPT Order Dated 12.2.2024 on DPC Promotion Procedures

Retired Employees and Promotions : Impact of Withdrawal of Latest DoPT Order Dated 12.2.2024 on DPC Promotion Procedures

Consequently Para ‘3’ of OM No. 22011/4/98-Estt.(D) dated 12.10.1998 has been restored with effect from 1st January, 2024

Withdrawal of DPC Procedure for Retired Employees and Promotions

OFFICE MEMORANDUM

Subject: Procedure to be followed by the Departmental Promotion Committee (DPC) with regard to retired employees – reg.

The undersigned is directed to invite reference to this Department’s O.M. of even number dated 12.2.2024 on the captioned subject revising provisions of para 3 of DoPT’s OM No. 22011/4/98-Estt.(D) dated 12.10.1998 with effect from 1.1.2024 i.e. vacancy year 2024 onwards).

2.It has now been decided to withdraw OM dated 12.2.2024 as non-est. Consequently, para ‘3’ of OM No. 22011/4/98-Estt.(D) dated 12.10.1998 stands restored with effect from 1st January, 2024. All Departmental Promotion Committee (DPC) meetings conducted till date as per provisions of OM dated 12.2.2024, may be reviewed accordingly.

3.All Ministries/Departments may take note of the above. Attention is again invited to 0.M. No. 22011/4/2013-Estt.(D) dated 8.5.2017, which stipulates that DPC is to be convened well in advance as per the Model Calendar so that the approved select panels are ready on the date of commencement of the vacancy year. Ministries/Departments may, therefore, strictly adhere to the Model Calendar and ensure timely conduct of DPCs in order to avoid delays.

Retired Employees and Promotions : Para ‘3’ of OM No. 22011/4/98-Estt.(D) dated 12.10.1998 to be restored with effect from 1st January, 2024

“The matter has been examined in consultation with the Ministry of Law (Department of Legal Affairs). It may be pointed out in this regard that there is no specific bar in the aforesaid Office Memorandum dated April 10, 1989 or any other related instructions of the Department of Personnel and Training for consideration of retired employees, while preparing year-wise panel(s), who were within the zone of consideration in the relevant year(s).

According to legal opinion also it would not be in order if eligible employees, who were within the zone of consideration for the relevant year(s) but are not actually in service when the DPC is being held, are not considered while preparing year-wise zone of consideration/panel and, consequently, their juniors are considered (in their places) who would not have been-in the zone of consideration if the DPC(s) had been held in time.

This is considered imperative to identify the correct zone of consideration for relevant year(s). Names of the retired officials may also be included in the panel(s). Such retired officials would, however, have no right for natural promotion. The DPC(s). may, if need be. prepare extended panel(s) following the principles prescribed in the Department of Personnel and Training Office Memorandum No.2201 1/8/87-Estt.(D) dated April 9, 1996.“

Declaration of 5th supplementary results CE - Postman from GDS

Instructions to the candidates applying for LDCE IP, scheduled to be held on 21st & 22nd September, 2024

Instructions to the candidates applying for LDCE IP, scheduled to be held on 21st & 22nd September, 2024

General Instructions:

Procedure for applying through Online:

View Submitted Applications:

Re-submission of application:

Re-submission of application – Preview:

- Candidates must check the correctness of their entries (data, photo, signature).

- If any entries are incorrect, click “Close Preview” to return to the data entry screen and modify the marked incorrect entries.

- If all marked entries are correct, click the “Submit” button. After submission, you will not be able to modify y

- our entries until the Controlling Authority returns the application for re-submission. Be sure all information is correct before submitting.

- Upon successful re-submission, you will receive an alert message stating, “Candidate application re-submitted successfully.”

- After successful submission, you will see a confirmation message on the screen and receive an SMS and email. The status of the sent email and SMS will also be displayed.

Conduct of Limited Departmental Competitive Examination (LDCE) for promotion to the cadre of Inspector Posts (66.66%) Departmental quota for the vacancy year 2024 - Uploading of Notification

Conduct of Limited Departmental Competitive Examination (LDCE) for promotion to the cadre of Inspector Posts (66.66%) Departmental quota for the vacancy year 2024 - Uploading of Notification

AIGDS CHQ Letter on - Excesses being perpetrated by lower-level officers against GDS for non-fulfillment of given targets

AIGDS CHQ Letter on - Excesses being perpetrated by lower-level officers against GDS for non-fulfillment of given targets.

Tuesday 23 July 2024

Income Tax Relief and Revised Tax Slabs in New Tax Regime – Union Budget 2024-25

Income Tax Relief and Revised Tax Slabs in New Tax Regime – Union Budget 2024-25

Ministry of Finance

GOVERNMENT MAKES NEW TAX REGIME MORE ATTRACTIVE

STANDARD REDUCTION INCREASED FROM ₹ 50,000 TO ₹ 75,000

SALARIED EMPLOYEE STANDS TO SAVE UP TO ₹ 17,500

Posted On: 23 JUL 2024 1:14PM by PIB Delhi

Several attractive benefits to provide tax relief to salaried individuals and pensioners opting for the new tax regime were announced by the Union Finance and Corporate Affairs Minister Smt. Nirmala Sitharaman while presenting the Union Budget 2024-25 in the Parliament today.

Finance Minister proposed to increase the standard deduction for salaried employees from ₹50,000 to ₹75,000. Also, deduction on family pension for pensioners is proposed to be enhanced from ₹15,000 to ₹25,000 under the new tax regime. This will provide relief to about four crore salaried individuals and pensioners.

Smt. Sitharaman proposed to revise the tax rate structure in the new tax regime, as follows:

Tax Relief and Revised Tax Slabs in New Tax Regime

0-3 lakh rupees | Nil |

3-7 lakh rupees | 5 per cent |

7-10 lakh rupees | 10 per cent |

10-12 lakh rupees | 15 per cent |

12-15 lakh rupees | 20 per cent |

Above 15 lakh rupees | 30 per cent |

As a result of these changes, a salaried employee in the new tax regime stands to save up to ₹ 17,500 annually in income tax.

******

→

→