Saturday 26 March 2022

Lok Sabha: Women Wing of Indian Army

Lok Sabha: Women Wing of Indian Army

GOVERNMENT OF INDIA

MINISTRY OF DEFENCE

DEPARTMENT OF MILITARY AFFAIRS

LOK SABHA

STARRED QUESTION NO. 340

TO BE ANSWERED ON 25TH MARCH, 2022

WOMEN WING OF INDIAN ARMY

*340. DR. UMESH G. JADHAV:

SHRI S. MUNISWAMY:

Will the Minister of Defence be pleased to state:

(a) whether the Government proposes to name the women’s wing of Indian Army in the name of Belawadi Mallamma, the first known warrior queen who formed the first specially trained women’s army in the Indian Subcontinent;

(b) if so, the details thereof;

(c) whether the said move is a unique and first of its kind initiative that will also serve as an inspiration to the women who aspire to join the Indian Army and if so, the details thereof;

(d) whether the Indian Army has named any organization/out-fit/wing till date in the name of a woman warrior; and

(e) if so, the details thereof?

ANSWER

MINISTER OF DEFENCE (SHRI RAJNATH SINGH)

(a) to (e): A statement is laid on the Table of the House.

STATEMENT REFERRED TO IN REPLY TO PARTS (a) to (e) OF THE LOK SABHA STARRED QUESTION No. 340 FOR ANSWER ON 25.03.2022 REGARDING ‘WOMEN WING OF INDIAN ARMY’:

(a) to (e): No, Sir. There is no separate Women Wing in the Indian Army. Women Officers are currently being commissioned in Indian Army in 10 different Arms/Services. Presently 100 Women soldiers are enrolled in the Corps of Military Police.

Holding of Nation-wide Pension Adalat, 2022

Holding of Nation-wide Pension Adalat, 2022

No. 1/39/2021-P&PW (E)

Government of India

Ministry of Personnel, P.G. & Pensions

Department of Pension & Pensioners Welfare

3rd Floor, Lok Nayak Bhawan,

Khan Market. New Delhi,

Dated March 21, 2022

OFFICE MEMORANDUM

Subject: Holding of Nation-wide Pension Adalat, 2022-reg.

The undersigned is directed to refer to Department of Pension & Pensioners’ Welfare DO letter of even number dated 10.01.2022 and dated 01.02.20222 (copies attached) from Secretary (Pension) addressed to all Secretaries for convening Nation-wide Pension Adalats in the third week of March, 2022, by each Ministry Department, Organization/Field-formation by leveraging technology through Video Conferencing.

2. It has now been decided to hold a Nation-wide Pension Adalat on Thursday, May 5, 2022 so that this Government initiative has an All India impact. Accordingly, all Ministries/Departments/Organizations are requested to make their arrangements for holding their Ministry/Department/Organization Nation-wide Pension Adalat, preferably through Video Conferencing on May 5, 2022.

3. The concerned grievance-holder also to be invited for the Adalat along with all the concerned officials to instantly settle the case/grievance. Grievances requesting a change in extant policy rules or not as per extant policy/rules need not be taken up in the Adalats.

Encl: as above

(Sanjoy Shankar)

Deputy Secretary to Govt of India

Lok Sabha Q Local purchase of medicine in AYUSH Wellness centres of CGHS

Lok Sabha Q Local purchase of medicine in AYUSH Wellness centres of CGHS

| ||||||||||||||||||||

Rajya Sabha Q -Proposal for additional quantum of Pension

Rajya Sabha Q -Proposal for additional quantum of Pension

GOVERNMENT OF INDIA MINISTRY OF PERSONNEL, PUBLIC GRIEVANCES AND PENSIONS (DEPARTMENT OF PENSION & PENSIONERS’ WELFARE) RAJYA SABHA UNSTARRED QUESTION NO. 2520 (TO BE ANSWERED ON 24.03.2022)

PROPOSAL FOR ADDITIONAL QUANTUM OF PENSION 2520 SHRI NARAIN DASS GUPTA: Will the PRIME MINISTER be pleased to state:

(a) whether the present pensions in the lower rungs are commensurate to the current higher cost of living, if adjusted to the rate of inflation;

(b) whether the proposal of the Parliament Standing Committee on additional quantum of pension to central pensioners below 80 years of age is being considered;

(c) whether Government has prepared a roadmap to implement the recommendations of the Standing Committee; and

(d) whether the re-implementation of the old pension policy is being considered by Government as pension is the only means of sustenance after retirement for a large sectio n of the society?

ANSWER

MINISTER OF STATE IN THE MINISTRY OF PERSONNEL, PUBLIC GRIEVANCES AND PENSIONS AND MINISTER OF STATE IN THE PRIME MINISTER’S OFFICE (DR. JITENDRA SINGH)

(a): Yes, Sir. In order to protect the erosion in the real value of basic pension on account of inflation, Dearness Relief is granted to the pensioners and family pensioners of Central Government. The rates of the Dearness Relief are revised periodically, at every six months, on the basis of rate of inflation as per All India Consumer Price Index for Industrial Workers released by Labour Bureau, Ministry of Labour and Employment.

(b) & (c): In its 110th report, the Department Related Parliamentary Standing Committee on Personnel, Public Grievances, Law and Justice expressed the view that the Government should sympathetically consider the demand of Pensioners’ Associations for additional quantum of pension at the rate of 5%, 10% and 15% of basic pension on attaining the age of 65 years, 70 years and 75 years, respectively to the pensioners and recommended the Department of Pension & Pensioners’ Welfare to pursue the matter with Ministry of Finance. Accordingly, after working out the likely financial implications based on the data made available by the concerned Departments, a reference in this regard has been made to Ministry of Finance (Department of Expenditure).

(d): There is no such proposal under consideration of the Government. *****

Supreme Court issued an interim order to permit disabled candidates who passed the civil service exam to apply for IPS

Supreme Court issued an interim order to permit disabled candidates who passed the civil service exam to apply for IPS

interim order allowing disabled candidates

On Friday, the Supreme Court issued an interim order allowing disabled candidates who passed the civil service exam to apply for IPS. The Supreme Court also granted applications to the Indian Railway Protection Force (IRPF), Delhi, Daman and Diu, Dadra and Nagar Haveli, Andaman and Nicobar, and Lakshwadeep Police Force, in addition to the IPS (DANIPS). The Supreme Court’s final decision, however, will influence future proceedings, including nomination.

The interim judgement was delivered by the Supreme Court in response to a petition filed by the non-governmental organisation National Platform for the Rights of the Disabled. The interim order was issued by a Supreme Court bench consisted of Justices A.M. Khanwilkar and Abhay S. Oka.

Thursday was the deadline for those who passed the civil service exam to apply for the service in which they want to work. The Supreme Court, on the other hand, has given the disabled until April 1 at 4 p.m. to file their applications. The application must be sent in person or by courier to the Secretary-General (UPSC).

Previously, disabled people were barred from joining the police force. In response to a petition, the Supreme Court granted an interim order. In response to the case, the Supreme Court allowed the Centre permission to produce a thorough affidavit. The matter will be heard by the Supreme Court on April 15.

In an earlier order issued in 2021, the Centre exempted all categories of posts in the Indian Police Service and Indian Railway Protection Force, among other services, from the provision of 4 percent reservation in employment for persons with benchmark disabilities, citing the nature of the work involved in these services. The Rights of Persons with Disabilities Act of 2016 specifies a 4% quota for persons with disabilities in government jobs.

In a separate notification, the government exempted all combatant personnel posts in Central Armed Police Forces such as Border Security Force, Central Reserve Police Force, Central Industrial Security Force, Indo-Tibetan Border Police, Sashastra Seema Bal, and Assam Rifles from the provisions of the 2016 Act. Earlier in 2018, the administration exempted all combatant personnel positions in the Armed Forces from the regulation.

Rationalisation of Income Tax Slabs: Rajya Sabha QA

Rationalisation of Income Tax Slabs: Rajya Sabha QA

RAJYA SABHA

RATIONALISATION OF INCOME TAX SLABS

(a) whether Government has assessed the impact of the current taxation system in disincentivising people from seeking higher earnings;

(b) if so, the details thereof, and if not, the reasons therefor;

(c) whether Government has taken cognisance of the sharp jump in personal income tax slabs from 5 per cent to 20 per cent slabs, 30 per cent slabs and in some cases, over 40% due to multiple cesses;

(d) whether Government is considering reduction or rationalisation of income tax slabs; and

(e) if so, the details thereof, and if not, the reasons therefor?

ANSWER

MINISTER OF STATE IN THE MINISTRY OF FINANCE (SHRI PANKAJ CHAUDHARY)

(a) and (b) India has progressive direct taxation system wherein an individual or Hindu undivided family (HUF) or an association of person or body of individuals is required to pay tax at a higher rate with an increase in income levels.

II. The progressive tax policy does not intend to disincentivise people from seeking higher earnings but recognizes that taxpayers play a major role in nation building by paying their taxes as per their capacity. With rising income levels, those in the higher income brackets, need to contribute more to the Nation’s development. This ensures vertical equity and makes our taxation regime progressive.

(c), (d) and (e) It is the stated policy of the Government to phase out tax exemptions and deductions provided under the Income-tax Act, 1961 (the Act) while simultaneously reducing the tax rates.

II. In line with this stated policy, Finance Act, 2020 amended the Act by way of insertion of section 115BAC in the Act to provide an option to individual and HUF taxpayers for paying income-tax at the following lower slab rates subject to certain conditions including that that they do not avail specified tax exemptions or deductions:

| Total Income (Rs) | Rate (%) (Optional Regime) |

| Up to 2,50,000 | Nil |

| From 2,50,001 to 5,00,000 | 5 |

| From 5,00,001 to 7,50,000 | 10 |

| From 7,50,001 to 10,00,000 | 15 |

| From 10,00,001 to 12,50,000 | 20 |

| From 12,50,001 to 15,00,000 | 25 |

| Above 15,00,000 | 30 |

III. As is evident from the above, under the optional taxation regime for individuals and HUF taxpayers, there is no sharp jump in the tax rates with higher income levels.

IV. . Maximum marginal tax rate of a taxpayer having total income exceeding Rs 5 crore will go over 40% after including surcharge and a health and education cess. As stated above the surcharge in such cases ensures that those in the higher income brackets contribute more to the Nation’s development.

*****

Source: Rajya Sabha

Increase in retirement age of Central Government Employees – No proposal under consideration of the Government: Rajya Sabha QA

Increase in retirement age of Central Government Employees – No proposal under consideration of the Government: Rajya Sabha QA

GOVERNMENT OF INDIA

MINISTRY OF PERSONNEL, PUBLIC GRIEVANCES AND PENSIONS

(DEPARTMENT OF PERSONNEL & TRAINING)

RAJYA SABHA

UNSTARRED QUESTION NO. 1886

(TO BE ANSWERED ON 17.03.2022)

INCREASE IN RETIREMENT AGE

1886 DR. ANIL AGRAWAL:

Will the PRIME MINISTER be pleased to state:

(a) whether there is any proposal with Government to increase the retirement age of Central Government employees; and

(b) if so, the details thereof?

ANSWER

MINISTER OF STATE IN THE MINISTRY OF PERSONNEL, PUBLIC GRIEVANCES AND PENSIONS AND MINISTER OF STATE IN THE PRIME MINISTER’S OFFICE

(DR. JITENDRA SINGH)

(a) & (b): There is no proposal under consideration of the Government to increase the retirement age of Central Government employees.

*****

Source: Rajya Sabha

Special recruitment drive for backlog vacancies – Rajya Sabha QA

Special recruitment drive for backlog vacancies – Rajya Sabha QA

SPECIAL RECRUITMENT DRIVE FOR BACKLOG VACANCIES

1889 DR. ANBUMANI

(a) whether Government has details of total number of Group I, II, IV and other employees belonging to SC, ST, OBC, EWS and general category currently working in PMO, Central Secretariat (all Ministries) and Cabinet Secretariat and current corresponding backlog vacancies;

(b) if so, Group, category and organisation-wise details thereof;

(c) whether Government has taken any special recruitment drive or any other steps to fill up the existing and backlog vacancies recently; and

(d) if so, the category and Group-wise detail ls thereof?

ANSWER

MINISTER OF STATE IN THE MINISTRY OF PERSONNEL, PUBLIC GRIEVANCES AND PENSIONS AND MINISTER OF STATE IN THE PRIME MINISTER’S OFFICE (DR. JITENDRA SINGH)

(a) to (d): Department of Personnel and Training (DoPT) collects online data regarding representation of SC, ST, OBC and EWS in various Ministries/Departments of the Government through the rrcps portal. Further, DoPT monitors the status of filling up of backlog reserved vacancies for SC, STs, and OBCs in ten major Ministries/Departments having more than 90% of the employees of the Central Government.

The statement containing Group-wise, category-wise and Ministry/Department-wise details of employees working in various Ministries/Departments of the Government of India, as 01.01.2021, is at Annexure-I & II. The statement containing details of total number of backlog vacancies in 10 major Ministries/Departments and backlog vacancies filled by them, as on 01.01.2021, is at Annexure-III.

Filling up of vacancies, including backlog reserved vacancies, is a continuous process. Instructions have been issued to all Ministries/Departments of the Government of India to constitute an in-House Committee for identification of backlog reserved vacancies, to study the root cause of such vacancies, to initiate measures to remove the factors causing such vacancies and to fill them up early including through Special Recruitment Drives.

*****

Source: Rajya Sabha

Penetration of IPPB Into Rural Areas

Penetration of IPPB Into Rural Areas

Friday 25 March 2022

CONSTITUTIONAL BODY STATUTORY BODY

CONSTITUTIONAL BODY STATUTORY BODY

REVISION & REVIEW first session (out of 2 sessions). RULES 29 & 29A CCS CCA RULES ,1965

REVISION & REVIEW first session (out of 2 sessions). RULES 29 & 29A CCS CCA RULES ,1965

Revision & REVIEW Rules 29 & 29A CCS CCA RULES, 1965. Second Session.

Revision & REVIEW Rules 29 & 29A CCS CCA RULES, 1965. Second Session.

Notification for Old Pension Scheme: Rationale for quoting Notification date 22/12/2003 as unamendable repeatedly

Notification for Old Pension Scheme: Rationale for quoting Notification date 22/12/2003 as unamendable repeatedly

GOVERNMENT OF INDIA

MINISTRY OF PERSONNEL, PUBLIC GRIEVANCES AND PENSIONS

(DEPARTMENT OF PENSION AND PENSIONERS’ WELFARE)

RAJYA SABHA

UNSTARRED QUESTION NO. 1891

(TO BE ANSWERED ON 17.03.2022)

NOTIFICATION FOR OLD PENSION SCHEME

1891 SHRI NEERAJ SHEKHAR:

Will the PRIME MINISTER be pleased to refer to answers to Unstarred Question 610 and Unstarred Question 285 given in the Rajya Sabha on December 12, 2021 and February 03, 2022 respectively and state:

(a) whether Government had amended Notification dated 22/12/2003 vide OM dated 17/02/2020 and had allowed Old Pension Scheme to officials whose examination process was completed before 01/01/2004;

(b) whether Supreme Court has also extended Old Pension Scheme (OPS) to thousands of officials whose advertisements were issued before 01/01/2004 by rejecting said Notification to the extent of date of joining as criterion for OPS in number of cases and the same have also been implemented by Government;

(c) if so, rationale for quoting Notification date 22/12/2003 as unamendable repeatedly; and

(d) by when general orders would be issued in view of Part (a) and (b) above?

ANSWER

MINISTER OF STATE IN THE MINISTRY OF PERSONNEL, PUBLIC GRIEVANCES AND PENSIONS AND MINISTER OF STATE IN THE PRIME MINISTER’S OFFICE (DR. JITENDRA SINGH)

(a) to (d): National Pension System (NPS) was introduced for Central Government employees by a Notification of Ministry of Finance (Department of Economic Affairs) dated 22nd December, 2003 for Central Government service w.e.f. 1st January, 2004. However, in some specific court cases where the selection of candidates had been made before 01.01.2004 but their actual appointment in the Government service could be made on or after 01.01.2004 due to various reasons, on the direction of the Hon’ble High Court of Delhi, the benefit of Old Pension Scheme was allowed to the petitioners. After considering all the relevant aspects and to extend the benefit to similarly placed Government servants in order to reduce further litigation, the Government had decided, vide an Office Memorandum No. 57/04/2019-P&PW(B) dated 17th February, 2020 of the Department of Pension & Pensioners’ Welfare, that in all cases where the results for recruitment were declared before 01.01.2004 against vacancies occurring on or before 31.12.2003, may be given a one – time option to be covered under the Central Civil Services (Pension) Rules, 1972.

Hon’ble Supreme Court has dismissed some of SLPs filed by Union of India against the orders of Hon’ble High Court of Delhi allowing benefit of old pension scheme to those Government servants whose selection process was completed after 01.01.2004. However, notification dated 22.12.2003 has not been challenged in these cases.

In view of the specific provisions of the Notification dated 22.12.2003, the date of advertisement for the vacancies is not considered relevant for determining the eligibility for coverage under the Old Pension Scheme or the National Pension System.

SAFE DRINKING WATER TO RURAL HABITATION

SAFE DRINKING WATER TO RURAL HABITATION

GOVERNMENT OF INDIA

MINISTRY OF JAL SHAKTI

DEPARTMENT OF DRINKING WATER AND SANITATION

LOK SABHA

STARRED QUESTION NO. *319

TO BE ANSWERED ON 24/03/2022

SAFE DRINKING WATER TO RURAL HABITATION

*319. SHRI SRIDHAR KOTAGIRI:

SHRI POCHA BRAHMANANDA REDDY:

Will the Minister of JAL SHAKTI be pleased to state:

(a) the steps taken by the Government to provide safe drinking water to rural habitations in the country considering that several of them are severely affected by water contamination;

(b) the details of Community Water Purification Plants (CWPPs) that have been sanctioned and operationalised in the country under the Jal Jeevan Mission;

(c) the steps taken by the Government to provide safe drinking water to villages in coastal areas of the country considering that many of these villages are greatly affected by seawater intrusion;

(d) whether there is any provision for setting up of CWPPs in such coastal regions; and

(e) if so, the details thereof and if not, the reasons therefor?

ANSWER

MINISTER OF STATE FOR JAL SHAKTI

(SHRI PRAHLAD SINGH PATEL)

(a) to (e) A Statement of reply is laid on the Table of the House.

Statement referred to in the reply to Lok Sabha Starred Question No. 319 due for reply on 24.03.2022

(a) & (b) To make provision of potable tap water supply in adequate quantity, of prescribed quality and on regular & long-term basis to every rural household in the country by 2024, since August, 2019, Government of India in partnership with States/ UTs, is implementing Jal Jeevan Mission (JJM) – Har Ghar Jal. Under JJM, while allocating the funds to States/ UTs, 10% weightage is given to the population residing in habitations affected by chemical contaminants. Under JJM, while planning for potable water supply to household through tap water connection, priority is to be given to quality-affected habitations. Since, planning, implementation and commissioning of piped water supply scheme based on a safe water source is likely to take Time, purely as an interim measure, States/ UTs have been advised to install community water purification plants (CWPPs) especially in Arsenic and Fluoride affected habitations to provide potable water to every household at the rate of 8–10 litre per capita per day (lpcd) to meet their drinking and cooking requirements.

Under Jal Jeevan Mission, States/ UTs have been advised to plan schemes of bulk water transfer from long distance in villages with water quality issues and non-availability of suitable surface water source in nearby areas.

As reported by States, as on 21.03.2022, States have taken up 6,249 community water purification plant (CWPP) schemes since launch of Jal Jeevan Mission.

(c) to (e) Rural drinking water supply is a State subject. Powers to plan, approve and implement water supply schemes is vested with States. The States may take up appropriate water treatment system depending upon techno-economic feasibility.

Revision of Minimum Wages

Revision of Minimum Wages

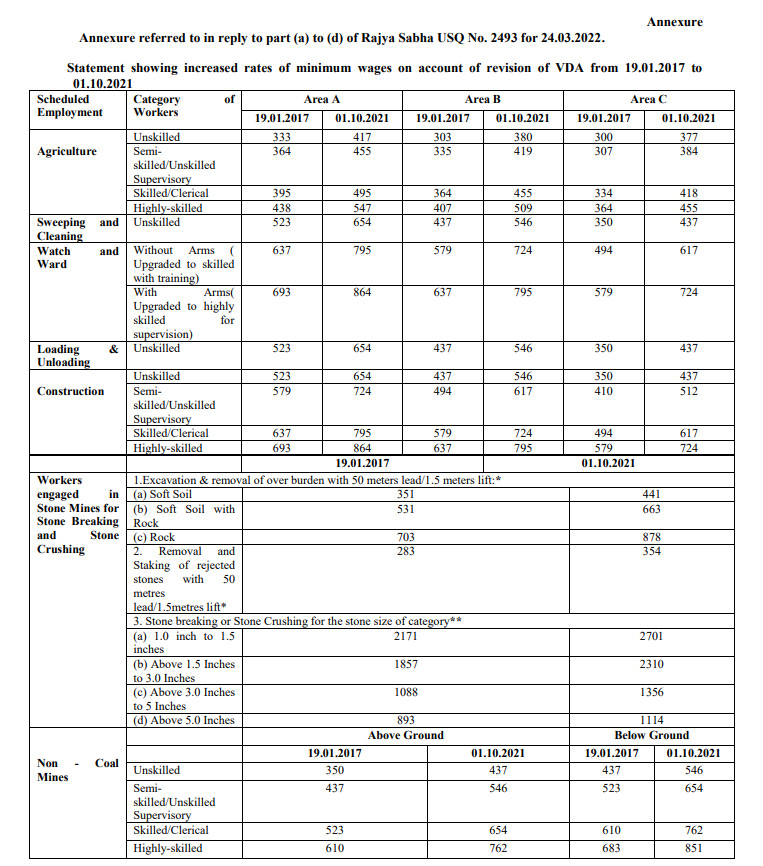

Section 3(1) (b) of the Minimum Wages Act, 1948 mandates the Central Government and the State Governments to review the minimum rates of wages so fixed in the Scheduled employments in their respective jurisdiction at intervals not exceeding five years and revise the minimum rates, if necessary. The minimum rates of wages in the Scheduled employments in the Central sphere were revised in 2017. Further, in order to take care of the rising prices, the Central Government revises the Variable Dearness Allowance (V.D.A) on basic rates of minimum wages every six months effective from 1st April and 1st October every year on the basis of Consumer Price Index for Industrial workers. V.D.A. was last revised w.e.f. 01.10.2021. A statement showing increase in the rates of wages since revision in 2017 on account of increasing V.D.A payable to the employees engaged in the scheduled employments in the Central Sphere is at Annexure.

The Government is not only committed to periodic review and revision of the minimum rates of wages but also to extend its coverage across employments and provide for floor wage. Accordingly, the provisions of the Minimum Wages Act, 1948, have been rationalized and amalgamated in the Code on Wages Act, 2019, as passed by the Parliament and notified on 08.08.2019. The Code on Wages, 2019, provides for universal minimum wage and floor wage across employments in organized and unorganized sector and the existing provision, under the Minimum Wages Act, 1948 to restrict applicability of minimum wages to Scheduled employments, has been dispensed with under the Code. The Code mandates the Central Government to fix floor wage applicable across the Central and the State sphere. The Code stipulates that the minimum rates of wages fixed by the appropriate Government shall not be less than the floor wage. The said provisions of the Code on Wages, 2019, have not come into force.

This information was given by Shri Rameswar Teli, Minister of State, Ministry of Labour & Employment in Rajya Sabha today.

Increase in the rates of wages since revision in 2017 on account of increasing V.D.A payable to the employees engaged in the scheduled employments in the Central Sphere

NPS to OPS: No proposal to reintroduce Old Pension Scheme : Rajya Sabha Q&A

NPS to OPS: No proposal to reintroduce Old Pension Scheme : Rajya Sabha Q&A

NPS to OPS: There is no proposal to reintroduce old pension scheme to Central Government civil employees joined on or after 01.01.2004. This information was given by Minister of State in the Ministry of Personnel, Public Grievances and Pensions and Minister of State in the Prime Minister’s Office, Dr. JItendra Singh in a written reply in Rajya Sabha today

RESTORATION OF OLD PENSION SCHEME

→

→