CBDT Notification No.36/2019 Dt. 12.4.2019 – Amendment in Form 16 and Form No. 24Q under Income Tax Act

MINISTRY OF FINANCE

(Department of Revenue)

(CENTRAL BOARD OF DIRECT TAXES)

(Department of Revenue)

(CENTRAL BOARD OF DIRECT TAXES)

NOTIFICATION

New Delhi, the 12th April, 2019

G.S.R. 304(E).—In exercise of powers conferred by sections 200 and 203 read with section 295 of the Income tax Act, 1961 (43 of 1961), the Central Board of Direct Taxes hereby makes the following rules further to amend the Income-tax Rules, 1962, namely:—

1. Short title and commencement

(1) These rules may be called the Income-tax (3rd Amendment) Rules, 2019.

(2) They shall come into force on 12th day of May, 2019.

(2) They shall come into force on 12th day of May, 2019.

2. In the Income-tax Rules, 1962, in Appendix II–

(A) in Form No. 16,–

(i) the “Notes” occurring after “Part A” shall be omitted;

(ii) for “Part B (Annexure), the following shall be substituted, namely:–

(i) the “Notes” occurring after “Part A” shall be omitted;

(ii) for “Part B (Annexure), the following shall be substituted, namely:–

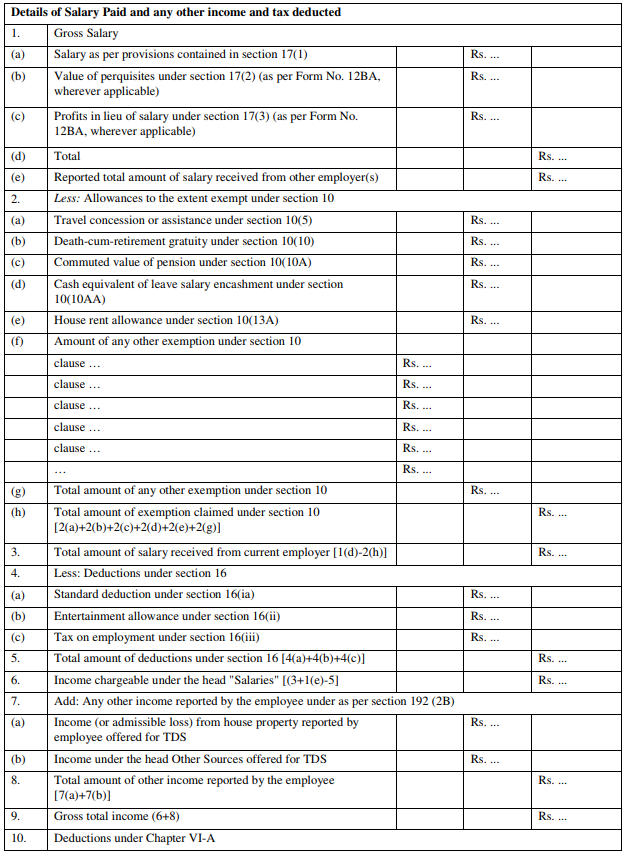

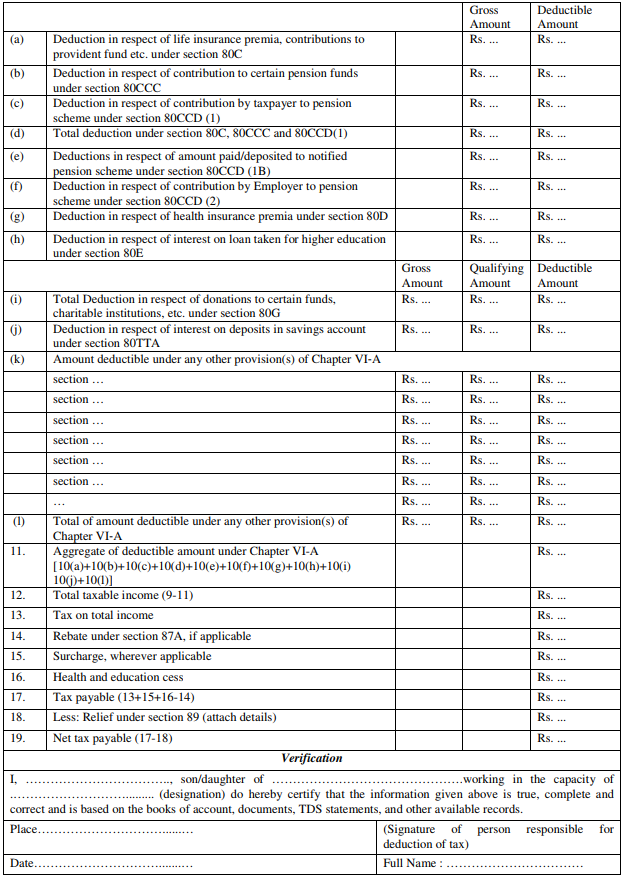

“Part B (Annexure)

Notes:

1. Government deductors to fill information in item I of Part A if tax is paid without production of an income-tax challan and in item II of Part A if tax is paid accompanied by an income-tax challan.

2. Non-Government deductors to fill information in item II of Part A.

3. The deductor shall furnish the address of the Commissioner of Income-tax (TDS) having jurisdiction as regards TDS statements of the assessee.

→

→

0 comments:

Post a Comment