For senior citizens, these are the best

ways to invest their money

There are several financial benefits offered to individuals upon

crossing the age of 60 years or 80 years. They are offered higher assured

returns on investments and greater tax exemptions.

Written by Adhil Shetty | New Delhi | Published: August 21, 2018 12:33:27 pm

There are several financial benefits offered to individuals upon crossing the age of 60 years or 80 years, including higher assured returns on investments and greater tax exemptions. This Senior Citizens’ Day here’s a look at what investment options are best suited for those who’ve crossed 60.

A person’s expectations of returns, and risk appetite, can change with age. Upon hitting the age of 60, an age at which many people choose to retire, one faces the challenge of not outliving the resources one has accumulated.

In order to attain optimal returns, maintain liquidity, and reduce risk, a good mix of fixed and market-linked products is necessary. Let’s look at the financial products that fit the portfolio of a senior citizen best.

Fixed deposit scheme for senior citizens

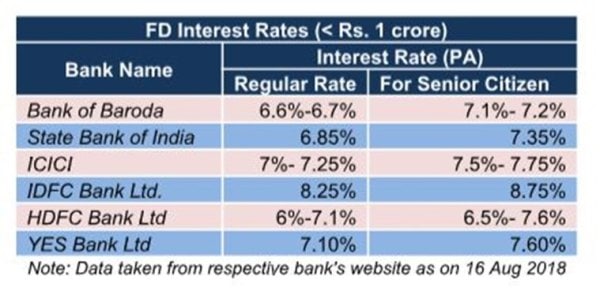

The investment tenure associated with fixed deposit schemes ranges from seven days to 10 years, and the rate of interest varies as per the tenure. Senior citizens enjoy an interest rate of around 0.25 per cent to 0.5 per centhigher than the regular rates.

So if the interest rate on FD is 7.5 per cent to 8 per cent per annum, senior citizens can avail interest of 7.75 per cent to 8.25 per cent.

Senior citizens are also entitled to a tax exemption of up to Rs 50,000 on interest income from investments such as bank FDs, post office saving schemes etc. This exemption under Section 80 TTB is not available to anyone under the age of 60. Also, five-year FDs qualify for tax deduction under Section 80 (C).

Some of the banks that offer attractive interest rate for the Senior citizen investors are mentioned in the table below.

High-interest savings account

High-interest savings accounts are low risk investment instrument that ensure high liquidity. The prevailing interest rate on such savings account range from 5 per cent to 7 per cent per annum. The most attractive feature of a high-interest savings account is that the interest is calculated on the daily balance, so the investor earns interest even if a corpus is deposited on Saturday and withdrawn after two days on Monday.

Also, there are deduction benefits under Section 80 TTA for interest earned up to Rs 10,000 in a financial year.

Senior citizen savings scheme (SCSS)

Among small savings schemes, Senior Citizens Savings Scheme is the one meant only for senior citizens. It offers an impressive, assured rate of interest rate of 8.3 per cent. it is also very safe due to being backed by the Government of India. This is a five-year deposit plan with nationalised banks/post offices which can be extended for another three years. One can invest up to Rs 15 lakh under SCSS, and avail a tax deduction up to Rs. 1.5 lakh under Section 80 (C).

The interest income is paid out in a quarterly basis under this scheme which fulfils the pension requirement of senior citizens.

Health insurance

This is a must-have for everyone, no matter their age. The sole purpose of a health insurance is to provide you financial support during a health emergency or disability. Given the increasing cost of healthcare in mind, the government has offered greater tax relief on the premiums paid towards insurance for senior citizens.

The tax exemption limit on premiums paid for senior citizens is now set at Rs 50,000 under Section 80D. For expenses borne towards treatment of critical ailments, the exemption limit is Rs 1 lakh under Section 80DDB from FY 2018-19.

Short-term debt and balanced mutual funds

Equity mutual funds are often perceived to be moderately risky investments. However, there is a whole range of low-risk mutual funds as well. These are well-suited for the needs of senior citizens. While the choice of fund would largely depend on the flow of income and risk appetite, a blanket recommendation for senior citizens would be to opt for liquid/short-term debt mutual funds or debt-oriented balanced mutual funds.

Debt-oriented balanced funds (also known as Monthly Income Plans) invest in a mix of fixed income and instruments and equity. All debt funds also offer indexation benefits after three years on long-term capital gains tax at 20.6 per cent, which makes the investment tax-efficient.

Retrieving money from open-ended debt funds is easy and can be done at any point. Over the long-term, this investment can provide high safety of capital, along with returns moderately higher than fixed deposits and small savings.

The writer is CEO, BankBazaar.

→

→

0 comments:

Post a Comment