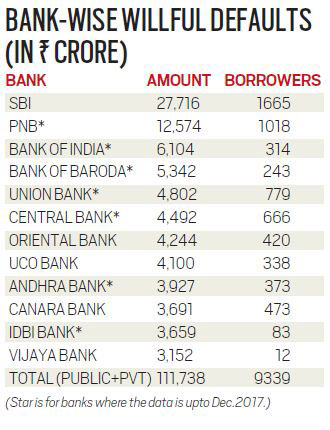

Rs 111,738 crore: That’s what 9,339 wilful defaulters owe, PSU banks hit most

The RBI is yet to disclose the full list of defaulters. In 2017, the RBI had told the Supreme Court that it was not in favour of publishing the list of loan defaulters who owe more than Rs 500 crore to public sector banks.

Indian banks have reported wilful defaults of over Rs 111,738 crore involving 9,339 borrowers who have the capacity to pay up but refuse to repay loans.

State-owned banks have reported wilful defaults of Rs 93,357 crore involving 7,564 borrowers as of September 2017, according to data available with the Credit Information Bureau of India Ltd (CIBIL). This is a 340 per cent surge in less than five years as total wilful defaults were just Rs 25,410 crore in 2013.

The RBI is yet to disclose the full list of defaulters. In 2017, the RBI had told the Supreme Court that it was not in favour of publishing the list of loan defaulters who owe more than Rs 500 crore to public sector banks.

The RBI has defined wilful default as one where the unit or borrower has defaulted in meeting payment or repayment obligations to the lender despite the capacity to honour these commitments. It also includes those who have siphoned off or not utilised funds for the specific purposes for which finance was availed of.

Borrowers who have disposed of or removed movable fixed assets or immovable property given for the purpose of securing a term loan are also wilful defaulters. “Most of these cases are fund diversion by promoters using the companies promoted by them,” banking sources said.

The Punjab National Bank, which is reeling under the impact of the Rs 11,400-crore alleged fraud by firms of diamantaire Nirav Modi, has wilful defaults of Rs 12,574 crore involving 1,018 borrowers as of December 2017, according to the latest data available from CIBIL.

PNB has listed Winsome Diamond (Rs 899 crore), Nafed (Rs 224 crore) and Apple Industries (Rs 248 crore) as major defaulters.

State Bank of India (SBI) leads the list with wilful defaults of Rs 27,716 crore by 1,665 borrowers. Major wilful defaulters of SBI include Kingfisher Airlines (Rs 1,286 crore), Calyx Chemicals (Rs 327 crore), J B Diamond (Rs 208 crore), Spanco Rs 347 crore), Zenith Birla (Rs 139 crore), Shreem Corp (Rs 283 crore), Zoom Developers (Rs 378 crore), First Leasing (Rs 403 crore) and GET Engineering (Rs 406 crore), according to the CIBIL data.

IDBI Bank has 83 wilful defaulters who owe Rs 3,659 crore to the bank. Major defaulters include Reid & Taylor (Rs 206 crore), S Kumar Nationwide (Rs 834 crore) and Deccan Chronicle (Rs 269 crore).

Bank of India has 314 wilful defaulters who owe Rs 6,104 crore — the major ones being Reid & Taylor (Rs 236 crore), Forever Precious Diamond (Rs 158 crore) and Mohan Gems (Rs 158 crore). Bank of Baroda’s top wilful defaulters are Kingfisher Airlines (Rs 432 crore) and ABC Cotspin (Rs 362 crore).

The RBI has allowed credit information bureaus such as like CIBIL to disclose the identity of wilful defaulters and those borrowers against whom banks have filed suits for recovery of loans. Regular suit-filed NPA (non-performing assets) accounts of banks involve loans of Rs 259,991 crore involving 16,844 borrowers. SBI leads with Rs 74,649 crore of 3,684 borrowers. Other nationalised banks have filed cases against 9,507 borrowers for recovery of Rs 129,636 crore, according to CIBIL data as of September 2017.

In 2017, the central bank told the Supreme Court that “the disclosure might involve the statutory, contractual and fiduciary rights of the defaulters” and argued that the grant of loans was covered by various statutes and contractual obligations. “Some of the banks and companies were against disclosing the names,” said an official source.

The Indian Express sought the full list of defaulters under the RTI Act but the RBI declined it, citing clauses of economic interests of the state, commercial confidence and information held in fiduciary capacity. The RBI also cited provisions of Section 45-E of the RBI Act, 1934 which prohibits disclosure of credit information.

Market regulator Securities and Exchange Board of India (Sebi) last year told companies to reveal cases of defaults to the stock exchanges. However, Sebi reversed its directive months later though Sebi’s original proposal was seen as a significant move as investors have complained about lack of disclosures on loan defaults and erosion in their wealth as default information reached them only at the final stage. The Sebi order on August 4, 2017 was contrary to the RBI’s position on loan defaults.

The total loan writeoff by banks in the last ten years is now over Rs 360,000 crore. Banks had written off Rs 228,253 crore in nine years — from fiscal 2007-08 to 2015-16. ICRA said that writeoffs amounted to Rs 132,659 crore in 2016-17 and the first six months of 2017-18.

Rating firm Crisil has said the stock of gross NPAs in the banking system is expected to rise to Rs 9.5 lakh crore by the end of this fiscal. NPAs started rising fast since fiscal 2015, and trebled from Rs 3.2 lakh crore seen then, after the RBI pushed banks to recognise NPAs on time rather than kick the can down the road.

→

→

0 comments:

Post a Comment